Advertisement|Remove ads.

Ethereum Falls As Bybit Gets Hit By The Biggest Crypto Hack in History – Retail Traders Fume

The cryptocurrency market took a hit after Bybit suffered what is now the largest hack in industry history, with over $1.46 billion in Ethereum (ETH) and staked Ethereum (stETH) drained from the exchange.

The breach has triggered a sell-off in digital assets, fueling liquidations in Ethereum futures markets.

As the broader crypto market slumped, ETH futures traders saw $114 million in liquidations over the past 12 hours, with $65 million coming from short positions, according to CoinGlass.

Over the past 24 hours, 187,073 traders were liquidated, bringing the total liquidation amount to $522.44 million.

Total cryptocurrency market capitalization declined 1.3% during U.S. trading hours, according to CoinGecko.

Ethereum dropped 1.8% in the past hour to $2,727, while Bitcoin (BTC) dipped 0.5%, falling below $98,000 after nearly touching $100,000 earlier in the day.

The Bybit breach now ranks as the largest crypto hack on record, surpassing Axie Infinity’s Ronin Network breach, which led to a loss of $625 million in ETH and USDC after attackers compromised validator nodes in March 2022.

Bybit co-founder and CEO Ben Zhou confirmed the attack in a post on X, explaining that hackers manipulated a planned transfer to gain control over the exchange’s ETH cold wallet.

Zhou said the attackers altered the smart contract logic, allowing them to drain funds to an unidentified address. Despite the loss, he assured users that Bybit remains solvent.

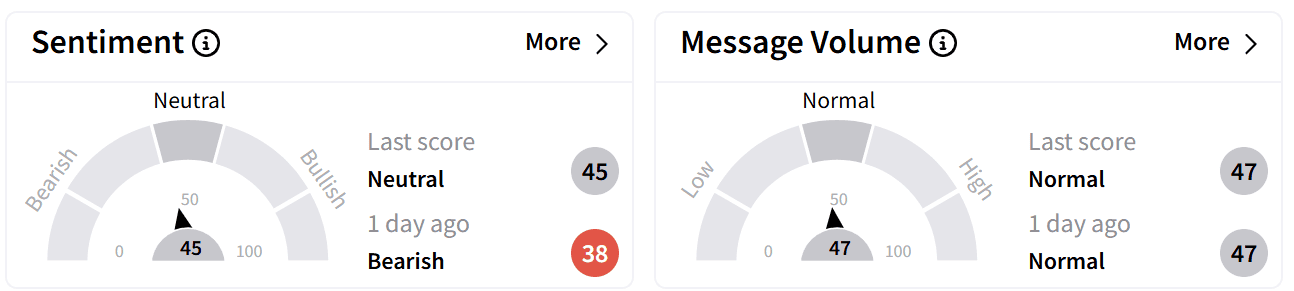

Despite the news, retail sentiment on Stocktwits around Ether (ETH) improved into the ‘neutral’ territory from ‘bearish’ a day ago.

Users on the platform expressed frustration over the sell-off and criticized Bybit for the security lapse.

In a livestream, Zhou said that the exchange currently has around 4,000 pending withdrawal transactions and asking investors for patience as the issue is resolved.

"We don't have plans to suspend or cancel withdrawals. At the moment, we are still receiving all the withdrawal requests, and, in fact, 70% of them have been approved and processed. A lot of the network congestion is still there, so we're processing them as fast as we can," he stated.

Zhou reassured customers that Bybit has sufficient funds to cover the losses. The company has secured 80% of the stolen funds through bridge loans from its partners and maintains a 1:1 asset backing to ensure liquidity, even in the event of a mass withdrawal.

He added that Bybit holds over $20 billion in assets under management (AUM), with the hack affecting only 4-5% of its total holdings.

On-chain intelligence firm Arkham has announced a new bounty to identify the hacker, offering 50,000 ARKM tokens as a reward for information.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Retail Traders Are Buying The Crypto Dip — But Not Bitcoin

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019709_jpg_f82a27a246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1005541622_jpg_8079d8d434.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)