Advertisement|Remove ads.

How A Single $26 Million Binance Order Helped A Trader Make $1.5 Million In Minutes

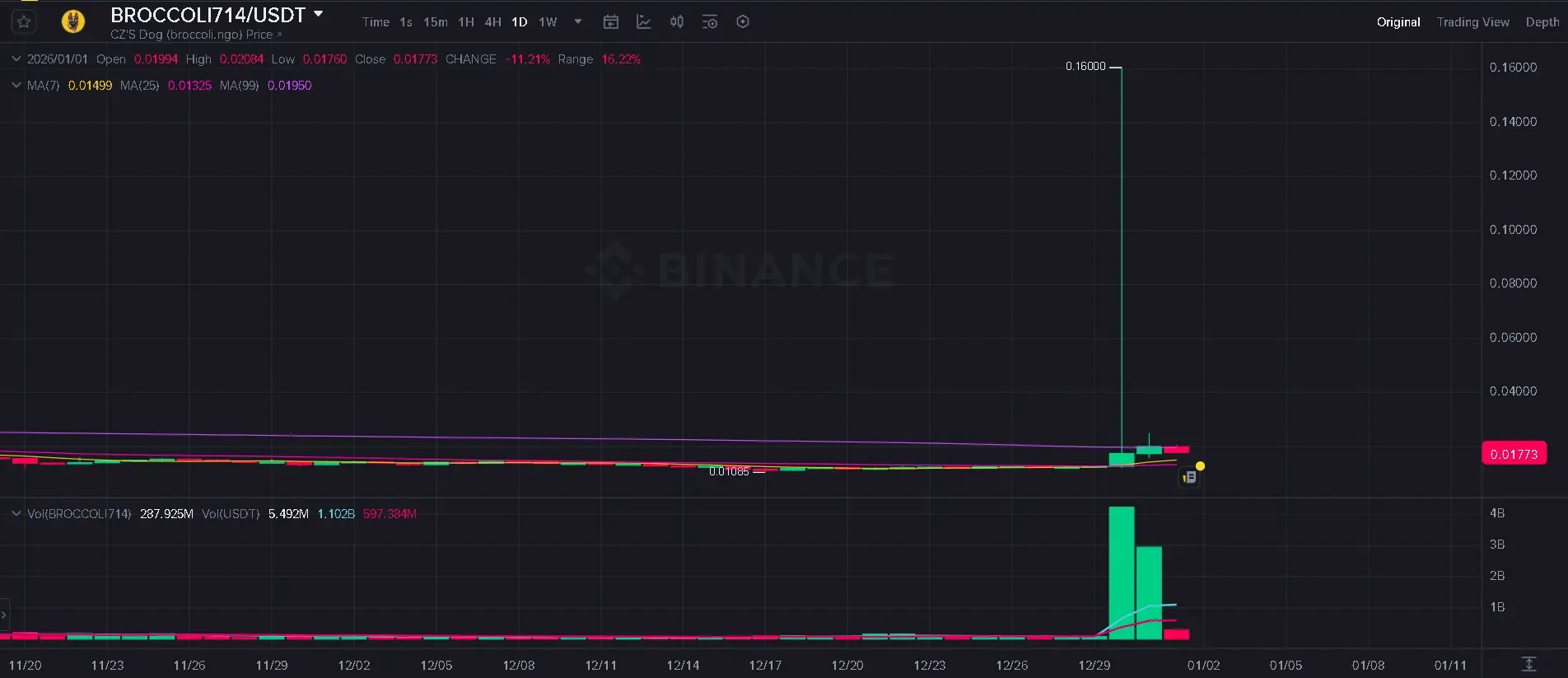

- According to crypto trader Vida, a little-known token called BROCCOLI714 was hit with an unusually large $26 million spot buy wall on Binance on New Year’s Day.

- Vida initially suspected the activity was caused by a technical glitch or a compromised account before taking a closer look at the order book.

- Binance’s temporary trading restrictions created brief price dislocations across markets, giving Vida opportunities to capitalize.

A crypto trader on X who goes by the name Vida made more than $1.5 million on New Year’s Day after spotting a highly unusual trading pattern on Binance (BNB) involving an under-the-radar token called BROCCOLI714.

BNB’s price gained 1.4% in the last 24 hours amid a broader crypto rally on Friday morning. On Stocktwits, retail sentiment around the token remained in ‘bullish’ territory over the past day amid ‘normal’ levels of chatter.

The Suspicious Trade

In a detailed thread on X, Vida said his alert system flagged a sudden surge of buy orders worth roughly $26 million in the token’s spot market, as per the platform's translation from Chinese. He noted that the scale of the bids stood out immediately since BROCCOLI714 had a market capitalization of just $40 million at the time, making the order size highly unusual for such a small asset.

Vida initially suspected a hacked account or a malfunctioning market-making bot. While the spot order book showed heavy demand, the futures market showed almost no activity. He stated that the imbalance suggested the price action was being driven by a single buyer rather than broad market participation.

A $26 Million Buy Wall Raises Red Flags

At the time of the alert, Vida said he was running a low-risk arbitrage strategy. His system held roughly $500,000 in short positions on BROCCOLI714 futures to hedge an equivalent long position in the spot market, a setup designed to earn steady funding fee income.

Vida stated that a closer look at the order book showed that a single participant had placed nearly $26 million in spot buy orders within 10% of the prevailing price. Futures market depth, by contrast, was only about $50,000. For a token of that size, the imbalance was extreme.

Vida concluded the buyer was likely attempting to push the price higher before exiting. He said that as long as the buy wall remained intact, upward price pressure was likely to continue.

Strategy Shift Amid Binance Curbs

Vida shifted from his conservative arbitrage approach into a directional trade, betting the price would keep climbing. As volatility increased, Binance temporarily restricted trading in the token, triggering sharp price jumps in some markets while others remained capped.

Vida said he used these brief windows to add to long positions at lower prices. When circuit breakers lifted momentarily, he built roughly $200,000 in long exposure at an average price near $0.046.

20 Minutes For $1.5 Million

Shortly afterward, the large buy wall began flickering on and off before disappearing entirely. Without that support, BROCCOLI714’s price collapsed. Within about 20 minutes of his initial alert, Vida had exited all positions, locking in roughly $1.5 million in profit.

Vida said he then reversed his position and profited further from the decline as the token fell back toward its original trading range.

Binance has not confirmed any hacking or wrongdoing tied to the episode. The exchange told Vida it found no clear signs of foul play. BROCCOLI714 has since returned to pre-spike price levels, and the identity of the large buyer remains unknown.

Read also: Crypto Adoption Grows, So Do The Scams – And Bitcoin ATMs Are Ground Zero, Says FBI

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260984359_jpg_566af2429c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Alphabet_jpg_b0657d669f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Brian_Armstrong_Coinbase_60d65adb96.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_moderna_logo_resized_c72083ff97.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2237640344_jpg_bc97a7240c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2245685477_jpg_ce08eb96cb.webp)