Advertisement|Remove ads.

Solana Leads Crypto Sell-Off As Lazarus Ties, Token Unlock Spark Retail Concerns

Solana (SOL) led the cryptocurrency market downturn on Monday, with its price sliding nearly 7% during U.S. trading hours as concerns mounted over its ties to recent high-profile hacks and memecoin scams.

The losses deepened Solana’s month-long decline, bringing its 30-day drop to 37%, the steepest among the top 10 cryptocurrencies by market capitalization.

Retail sentiment on Stocktwits soured after on-chain investigator ZachXBT linked wallets involved in the $1.46 billion Bybit hack to scams operating on Solana’s memecoin platform, Pump.fun, in a post on Telegram.

The Bybit exploit, attributed to North Korea’s Lazarus Group, is the largest crypto exchange hack on record.

ZackXBT’s investigation tied the same wallets to the $29 million Phemex (PT) hack in January, indicating repeated abuse of Solana’s ecosystem for fraudulent activity.

The blockchain has struggled with a series of memecoin scams, including a $107 million rug pull involving the Libra token.

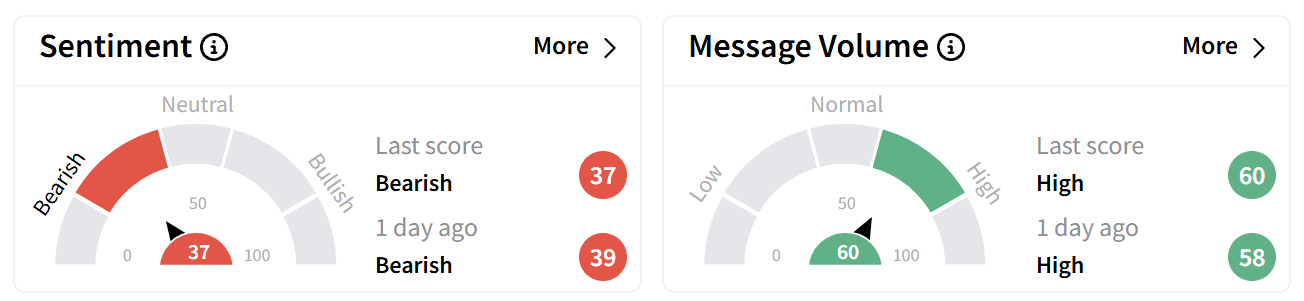

Retail sentiment on Stocktwits reflected the pessimism, with discussions around Solana trending in the ‘bearish’ zone.

One user suggested that a break below $150 – implying an additional 5% downside – could push the token as low as $120.

Adding to investor concerns is an upcoming token unlock event on March 1, when 11.16 million SOL, worth approximately $1.79 billion, will be released from the FTX estate.

Market uncertainty about potential liquidation from the estate has fueled risk aversion, as traders brace for increased sell pressure.

Solana’s memecoin sector was down over 15% for the day, according to CoinGecko.

Top tokens like Official Trump (TRUMP) , Bonk (BONK), and Dogwifhat (WIF) posted steep losses of 7%, 6.9% and 8.7% respectively.

Solana remains 46.2% below its all-time high of $293.31, reached on Jan. 19, when the TRUMP and MELANIA tokens launched, fueling a speculative frenzy.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Ethereum Under Pressure – Bybit Replenishes $1.23B ETH Reserves, Stolen Funds May Head to Mixers

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)