Advertisement|Remove ads.

Tether Moves To Stop Shareholder Exodus As Company Aims for OpenAI, SpaceX-Level Valuation: Report

- Pressure reportedly emerged after a shareholder attempted to sell stock at a price below the valuation sought in its capital raise.

- Tether said it received confirmation that the attempted discounted sale will not go forward.

- The planned raise would value Tether at nearly $500 billion, placing it among the largest private firms globally, alongside SpaceX and OpenAI.

Tether (USDT) is reportedly exploring buybacks and potential tokenization of its own shares as it works to manage investor liquidity during a planned $20 billion capital raise.

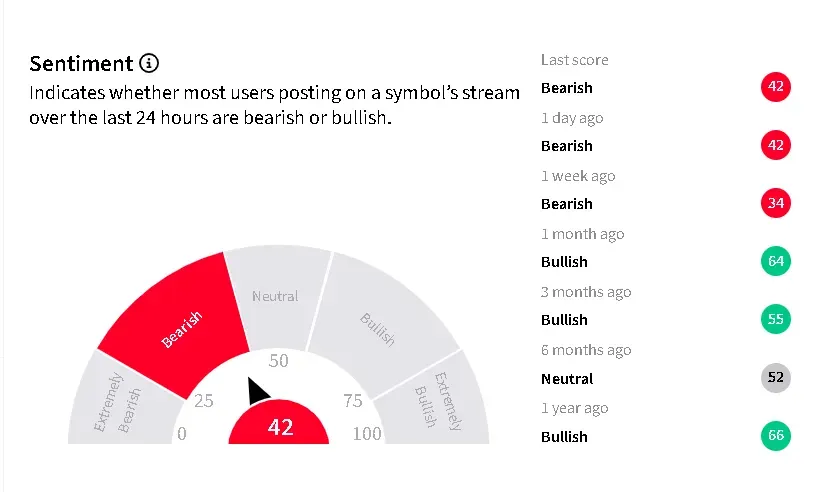

The discussions come after some existing shareholders sought to sell their stakes, prompting Tether to step in and block the transactions, according to a Bloomberg report. On Stocktwits, retail sentiment around the world’s largest stablecoin issuer remained in ‘bearish’ territory over the past day, down from ‘bullish’ a month ago.

Shareholder Attempts To Sell At Major Discount

The liquidity push follows an incident in which at least one shareholder attempted to sell stock at a steep discount to the roughly $500 billion valuation Tether is targeting in the raise, according to the report. Such a valuation would place the stablecoin issuer among the world’s most valuable private companies alongside SpaceX and OpenAI.

Tether intervened to halt that attempted sale, telling Bloomberg that it has “received clear confirmation that these efforts will not proceed.” The company did not identify the investors involved.

“It would be imprudent, and indeed reckless, for any investor to attempt to circumvent the established process led by Tier 1 Global Investment Banks or to engage with parties not authorized by Tether’s management,” it added.

Tether’s $20 Billion Fund Raise

CEO Paolo Ardoino confirmed in September that Tether was “evaluating a raise from a selected group of high-profile key investors.” It is reportedly looking to raise between $15 billion and $20 billion in exchange for a roughly 3% stake through a private placement.

That process has now drawn unexpected pressure from shareholders looking to exit. People familiar with the matter told Bloomberg that Tether is reviewing options, including repurchasing shares and issuing tokenized equity on a blockchain, once the raise is complete.

Tether’s USDT dominates $310 billion stablecoin sector, with $186 billion of the token in circulation, according to data on DeFiLlama. The company forecast its profit may reach roughly $15 billion this year.

Read also: Solana Outperforms Bitcoin, Ethereum After Firedancer Validator Goes Live On Its Mainnet

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_6549f7641a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_digitalpayments_resized_png_5e564e753b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2208385583_jpg_9511ec9642.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229273911_jpg_6b4851e2cc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_autozone_resized_jpg_8733836467.webp)