Advertisement|Remove ads.

Tom Lee-Backed BMNR Stakes Over A Quarter Of Its Ethereum Treasury Ahead Of Shareholder Vote

- BMNR’s stock rose as much as 3.6% in pre-market trade as Ethereum’s price also gained.

- The company staked another 186,650 Ethereum overnight, boosting its total staked balance to 1.53 million ETH.

- The uptick in staking activity comes ahead of a shareholder vote on Thursday, where BMNR is looking for approval to authorize new shares.

Tom Lee-backed Bitmine Immersion Technologies (BMNR) has staked more than a quarter of its Ethereum (ETH) holdings to earn additional yield from its crypto treasury.

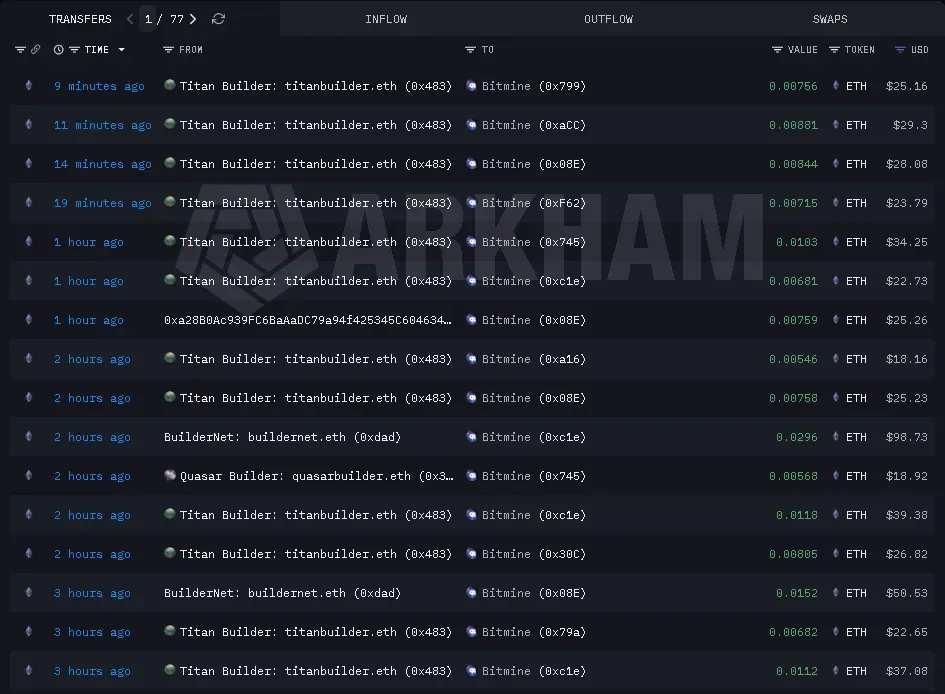

According to data from Arkham Intelligence, spotted by Lookonchain, the company staked an additional 186,560 ETH on Tuesday, bringing its total staked balance to roughly 1.53 million ETH, valued at about $5.13 billion at current prices.

Bitmine’s total Ethereum holdings stand at approximately 4.16 million ETH, following the addition of 24,366 ETH on Monday. The move means more than 25% of the company’s crypto treasury is now deployed in yield-generating activity.

BMNR Stock Rallies Alongside Ethereum

BMNR’s stock gained 3.6% in pre-market trade on Wednesday as Ethereum’s price rose 6.1% in the last 24 hours to cross $3,300. Retail sentiment around Bitmine on Stocktwits flipped to ‘bullish’ from ‘bearish’ over the past day as chatter rose to ‘high’ from ‘low’ levels. Platform data showed a 139% jump in message volume over that time.

Retail sentiment around Ethereum also ticked higher, improving to ‘neutral’ from ‘extremely bearish’ as chatter rose to ‘normal’ from ‘low’ levels.

It’s Almost Shareholder Vote Time

Bitmine shareholders are scheduled to vote on the company’s proposal to increase authorized shares from 500 million to 50 billion on Thursday. It would allow the Ethereum DAT to pick up more of the token and achieve its goal of accumulating 5% of ETH’s total circulating supply.

"We need to pursue this increase now as Bitmine is soon to exhaust its current 500 million authorization," Lee said on Monday. "And when that happens, our ETH accumulation will slow."

The uptick in staking is a signal to the market that with more shares available, Bitmine is likely to buy more Ethereum and then lock it away to earn returns for shareholders. The vote needs 50.1% approval, with some having concerns over dilution.

Read also: GPUS, SBET Lead Crypto Stocks Rally Following Bitcoin’s Surge To $96,000

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242061511_jpg_742d610600.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_eli_lilly_hq_resized_af4cc05fd5.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2204154647_jpg_b295df5f6b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_atomera_logo_resized_97a56614c5.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)