Advertisement|Remove ads.

Treasury Chief Bessent Says Trump’s Bitcoin Strategic Reserve Could Expand Beyond Seized Assets, Include Altcoins

Bitcoin dipped below $90,000 during U.S. market hours on Friday as Treasury Secretary Scott Bessent hinted that President Donald Trump’s Bitcoin Strategic Reserve could eventually include other cryptocurrencies and even acquire altcoins beyond assets already seized by the government.

In a CNBC interview, Bessent also called for bringing Bitcoin (BTC) onshore, criticizing the U.S. government’s previous sales of the apex cryptocurrency.

“I think that the Bitcoin Reserve — before you can accumulate it — you have to stop selling it,” he said.

BTC rebounded from a 24-hour low of just under $85,000, according to CoinGecko data, after an initial drop triggered by Trump’s executive order establishing the reserve.

The order outlines that the reserve will be primarily composed of Bitcoin seized by the government.

Trump’s plan also includes a secondary "crypto stockpile," which would hold additional digital assets the government may confiscate in the future.

However, contrary to speculation, he made no mention of taxpayer-funded acquisitions of altcoins such as Ripple’s XRP, Solana’s SOL, or Cardano.

Bessent, speaking to CNBC, clarified that the reserve would start with Bitcoin but left the door open for other assets.

“Seized crypto assets would go into the reserve first, then we'll see the way forward for more acquisitions,” he said. “And we're starting with Bitcoin, but it's an overall crypto reserve.”

His comments reignited interest among retail traders, who are watching for potential altcoin inclusion.

According to an ongoing Stocktwits poll, over 70% of traders anticipate further announcements at the White House Crypto Summit, with 39% focused on Trump’s Bitcoin strategy and 33% monitoring developments on the inclusion of altcoins.

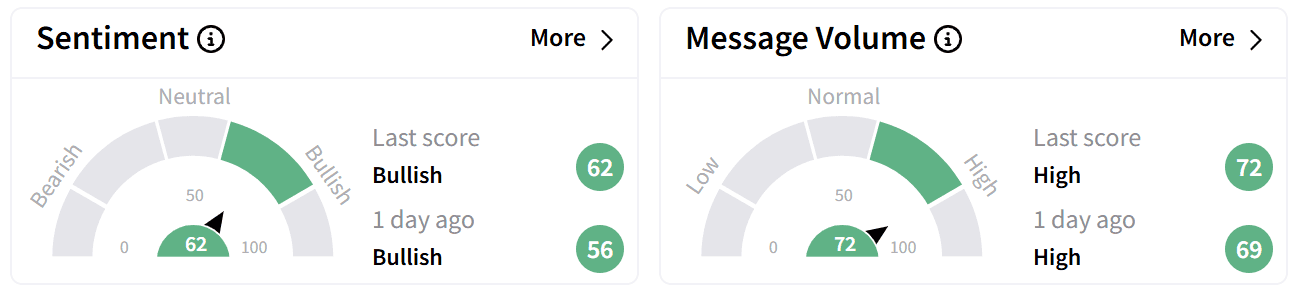

Retail sentiment on Stocktwits around Bitcoin rose further into ‘bullish’ territory, accompanied by ‘high’ levels of chatter.

According to platform data, Bitcoin was the top trending ticker with the most retail buzz in the last 24 hours.

One user argued that Thursday’s drop was a “fake out” and predicted a rally following the White House Crypto Summit.

Another trader compared Bitcoin’s current setup to its breakout above $50,000 last year, suggesting the cryptocurrency may climb higher regardless of news flow.

Bitcoin’s price has dipped nearly 8% over the past month but remains up by 35% over the past year.

The apex cryptocurrency is currently trading 17% below its all-time high of nearly $109,000 in January.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Ui_Path_resized_210dc0332c.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_006db9f466.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tesla_jpg_2554310f4f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_solaredge_technologies_resized_56b964ed87.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_aldyera_jpg_04cdfd0201.webp)