Advertisement|Remove ads.

Wolfspeed Plans Job Cuts As It Pushes For Positive Cash Flow – Retail Cautious As Chips Act Uncertainty Weighs

Wolfspeed (WOLF) shares edged up more than 1% in pre-market trade on Friday after the semiconductor company announced job cuts to accelerate its push toward positive free cash flow.

The company plans to reduce its workforce by about 180, primarily in material operations at its Durham and Siler City locations.

Over the next six months, Wolfspeed expects to cut its headcount by 20% as it scales back certain manufacturing capabilities.

The company also disclosed in a securities filing that it anticipates taking a one-time charge related to litigation in the third quarter (Q3).

It projects capital expenditures to be between $150 million and $200 million in the fiscal year 2026, with a sharp reduction to $30 million to $50 million in the fiscal year 2027.

Wolfspeed said it aims to break even on an adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) basis at $800 million in annualized revenue.

It also expects to generate approximately $200 million in unlevered operating cash flow in the fiscal year 2026, assuming revenue targets are met.

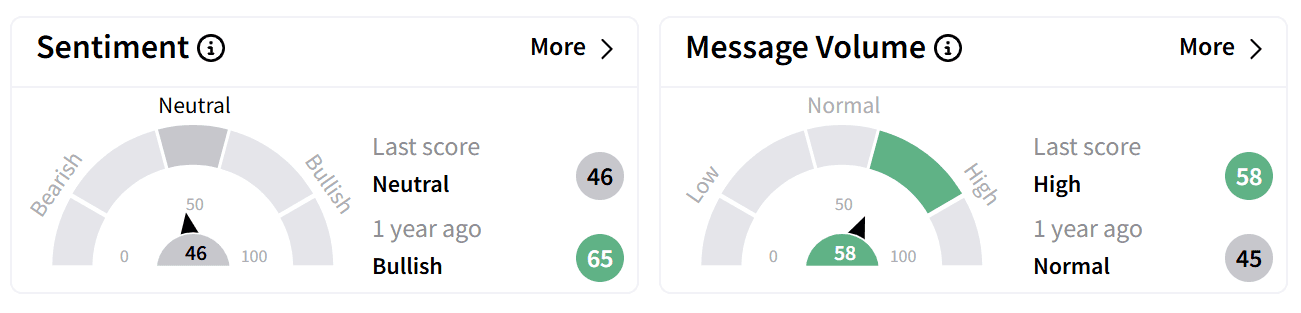

On Stocktwits, retail sentiment around Wolfspeed’s stock dipped to ‘neutral’ from ‘bullish’ a day ago, accompanied by an uptick in chatter to ‘high’ levels.

According to platform data, message count on the ticker increased by over 76% over the past 24 hours.

Traders appear more concerned about the status of Wolfspeed’s CHIPS Act funding after President Donald Trump proposed eliminating the federal semiconductor grant during a joint session of Congress on Wednesday.

Securing CHIPS Act funding remains critical for Wolfspeed as it works to stabilize its balance sheet following last year’s production delays and liquidity challenges.

In October, the company was awarded $750 million to support its planned $5 billion materials facility in western Chatham County and its existing fabrication site in New York’s Mohawk Valley.

Like all CHIPS Act grants, Wolfspeed’s award is contingent on hitting key milestones. The company has secured a $750 million private loan and raised $200 million through an at-the-market (ATM) offering.

Another requirement is obtaining a certificate of occupancy for its Siler City plant. Wolfspeed received a conditional certificate last week and expects the final certificate by June.

Before receiving CHIPS funds, the company must also begin producing materials at the new factory and address its convertible debt obligations due in 2026.

Wolfspeed’s shares have fallen more than 25% year-to-date and are down over 80% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)