Advertisement|Remove ads.

100 Days Or Never? Retail Investors Debate Trump’s Potential Bitcoin Reserve Timeline

Major changes to U.S. monetary policy don’t happen overnight, but retail investors believe a Bitcoin (BTC) reserve under President Donald Trump could be an exception.

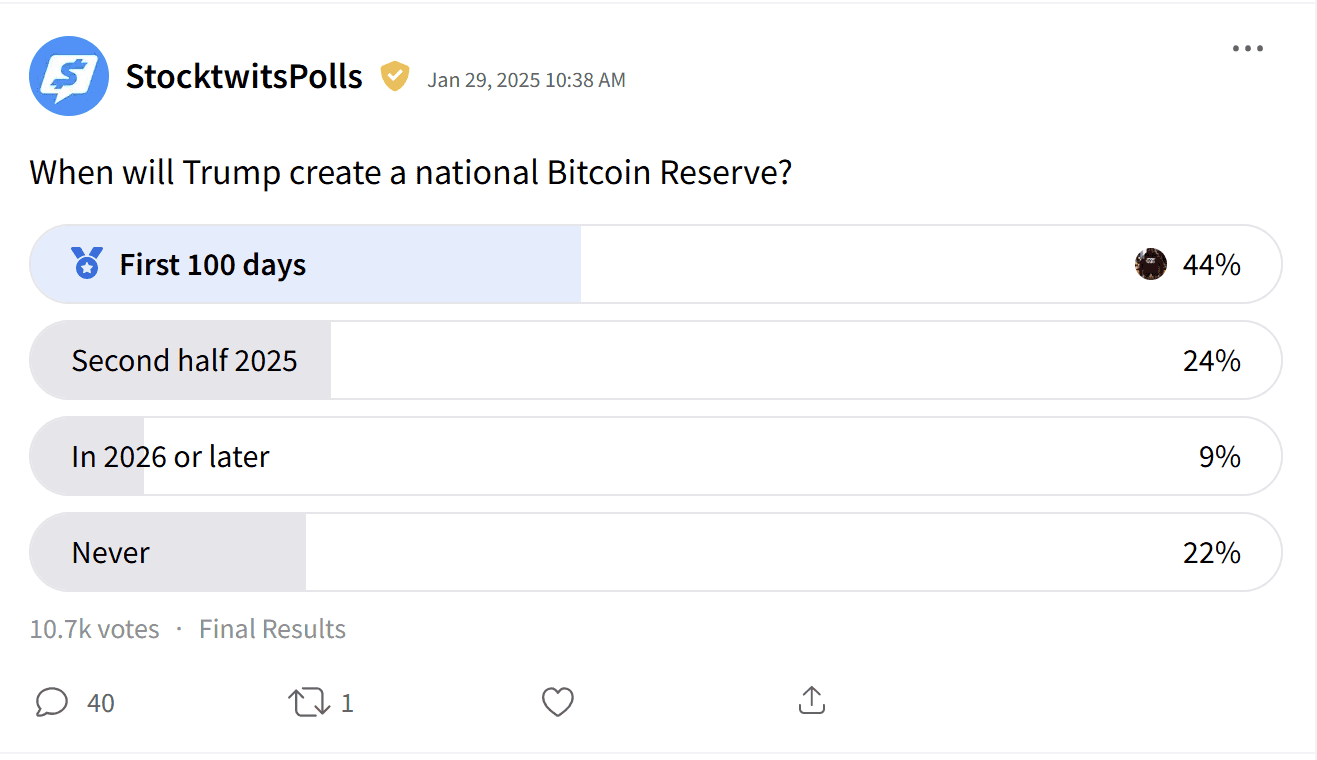

A Stocktwits poll found that 68% of investors expect Trump to create a national Bitcoin reserve in 2025, though opinions vary on when it might happen.

Forty-four percent believe it will be within his first 100 days in office, while 24% expect it to happen in the latter half of the year.

The 22% of investors who don’t believe a Bitcoin reserve will ever materialize argue that Trump’s pro-crypto rhetoric may not translate into actual policy.

Moreover, central banks worldwide remain cautious about adopting Bitcoin as a reserve asset, citing volatility and lack of regulatory oversight.

As recently as the European Central Bank’s (ECB) monthly monetary policy meeting on Thursday, President Christine Lagarde said she was “confident” that Bitcoin “will not enter the reserves” of banks in the European Union (EU) despite several EU countries – like Switzerland, Germany, Poland and others – currently considering BTC as a foreign reserve asset.

“Reserves have to be liquid, reserves have to be secure, they have to be safe, they should not be plagued by the suspicion of money laundering or other criminal activities,” she said.

Meanwhile, retail investors who do expect the reserve to be created have doubts about whether Bitcoin is the real focus, speculating that Trump’s initiative could prioritize U.S.-developed digital assets like Ripple (XRP) or Solana (SOL) — or even his own meme coin, Official Trump (TRUMP).

One Stocktwits user noted that if Trump delays the reserve until late 2025, it may be "too late in the cycle" for significant profits.

Last week, Trump’s administration took its first step toward a ‘national digital asset reserve’, but stopped short of creating a Bitcoin reserve outright — a move some crypto advocates had hoped for.

In addition to evaluating a strategic crypto stockpile, Trump also halted the development of a central bank digital currency (CBDC), marking a sharp break from prior U.S. policy.

Bitcoin has traded flat over the past 24 hours, according to CoinGecko data.

Earlier this week, it briefly dropped below $100,000 after news of DeepSeek, a low-cost artificial intelligence model from China, triggered a broader market sell-off.

The development led to concerns that AI-related spending could slow down, dragging down tech stocks and causing the Nasdaq 100 to fall 3%, with Bitcoin following the broader trend.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Bitcoin, Ethereum Gain As Powell Reaffirms Banks Can Engage with Crypto: Retail Still Feels Skiddish

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)