Advertisement|Remove ads.

Bitcoin, Ethereum Gain As Powell Reaffirms Banks Can Engage with Crypto: Retail Still Feels Skiddish

Bitcoin (BTC) and Ethereum (ETH) rose on Thursday, reversing initial losses after the Federal Reserve held interest rates steady and reiterated concerns about inflation.

Bitcoin climbed 2.6% in early trading to trade above $105,000, while Ethereum gained 2.8%, hovering above $3,200.

The Fed’s decision to maintain rates between 4.25% and 4.5% initially pressured risk assets, including cryptocurrencies, but markets quickly rebounded.

Crypto investors appear to be looking past the central bank’s cautious tone, focusing instead on Fed Chair Jerome Powell’s remarks that banks can serve cryptocurrency customers if they manage associated risks.

Powell’s comments on Wednesday followed the Securities and Exchange Commission’s (SEC) repeal of Staff Accounting Bulletin (SAB) 121, a regulation that previously discouraged banks from offering crypto custody services.

The rollback could make it easier for financial institutions to engage with digital assets, a move welcomed by crypto advocates.

Bitcoin also found support from a new legislative proposal in Illinois.

House Bill 1844 (HB1844), introduced by State Representative John Cabello, aims to create a strategic Bitcoin reserve as a financial asset in the state treasury.

The bill suggests a five-year holding period, after which the state could sell, transfer, or convert its holdings into another cryptocurrency.

Despite these developments, some investors remain cautious.

Historically, high interest rates weigh on speculative assets, and the Fed has signaled that inflation remains above target, suggesting that rate cuts may not come soon.

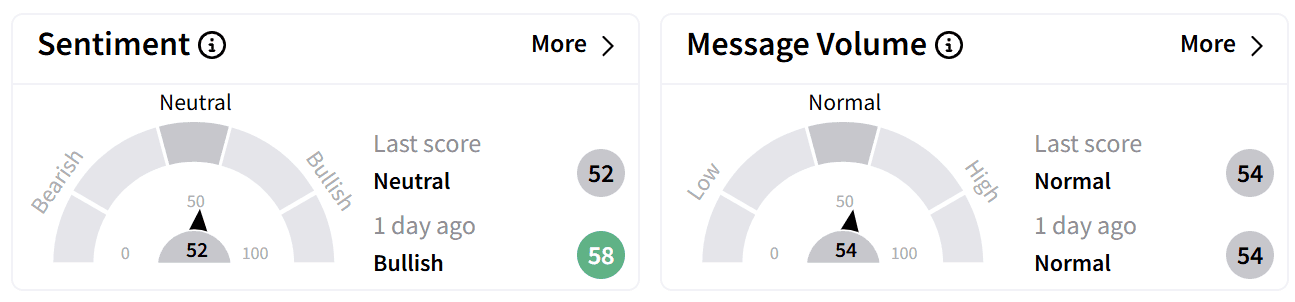

On Stocktwits, retail sentiment around BTC dipped to ‘neutral’ territory from ‘bullish’ as chatter remained at ‘normal’ levels on Thursday morning.

One user expressed skepticism, stating that Powell’s warning that banks must exercise caution when handling new asset classes like cryptocurrencies, especially within the federal safety net, was not particularly bullish for digital assets.

Others remained more optimistic, with one predicting that Bitcoin could hit $120,000, setting a new all-time high.

Bitcoin’s price has more than doubled over the past year, rising 11.7% so far in 2025.

However, it remains 3.2% below its all-time high of $108,786, reached on Jan. 20, ahead of President Donald Trump’s inauguration.

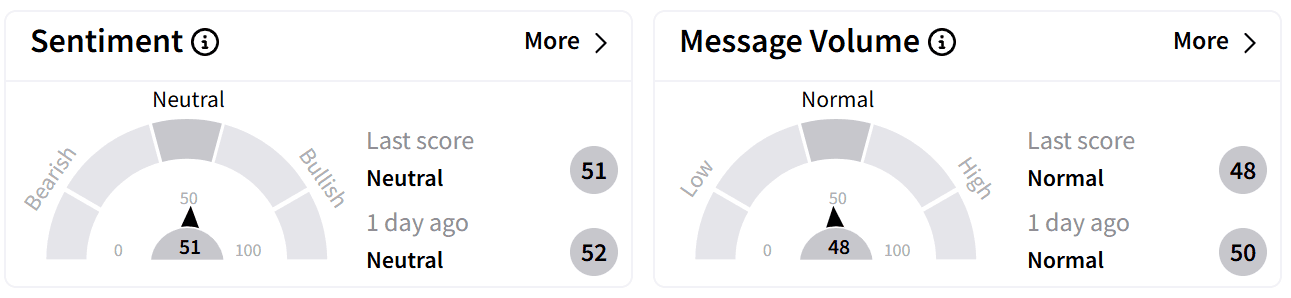

Retail sentiment on Stocktwits around Ethereum was also in the ‘neutral’ zone as chatter remained at ‘normal’ levels.

Users were bullish on Ethereum holding steady, forecasting that a longer consolidation period may precede a more extended rally.

Compared to Bitcoin (BTC), which registered over 100% returns, Ethereum only gained 39% over the last year. So far in 2025, the second-largest crypto by market cap is down 5.2%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Cardano Gains On Plomin Hard Fork Approval, Binance Support: Retail Sentiment Improves

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)