Advertisement|Remove ads.

Trump Slaps New Tariffs On Europe Over Greenland Deal As Markets Hold Steady

- President Donald Trump announced that he would levy a 10% tariff on major European allies beginning Feb. 1, which will rise to 25% from June.

- He called Greenland an important geostrategic asset, which he said, if taken over by China and Russia, would pose a direct threat to U.S. national security.

- However, Senate Democrats are moving to block the measure, according to Chuck Schumer.

President Donald Trump announced a new set of U.S. tariffs on Denmark, Norway, Sweden, France, Germany, the UK, as well as the Netherlands and Finland.

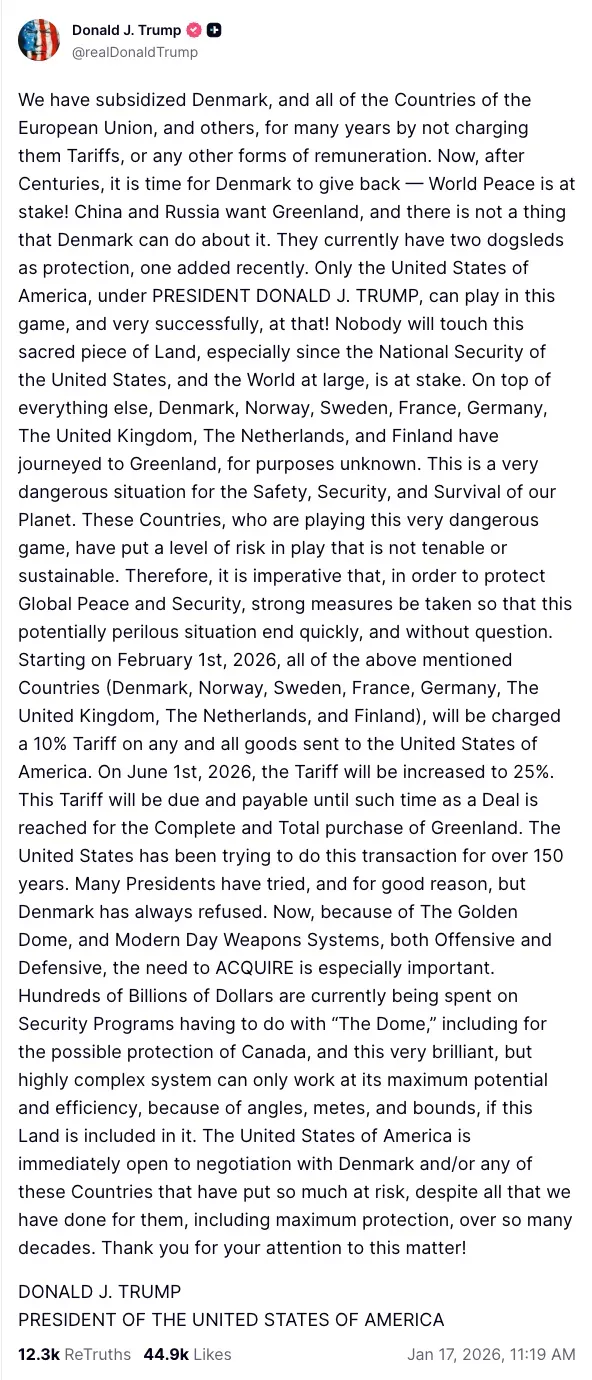

President Trump wrote on Truth Social on Saturday that a 10% tariff will be put into place from February 1, and it will rise to 25 % from June 1. President Trump added that they would remain until a deal is reached for the U.S. to purchase Greenland. “World Peace is at stake! China and Russia want Greenland, and there is not a thing that Denmark can do about it,” said Trump.

Trump said the United States has “subsidized Denmark” and much of Europe for decades by declining to impose tariffs, and that it is now “time for Denmark to give back.” He cast Greenland as a vital geostrategic asset and that American national security was at stake. The portrayal of tariffs as a geopolitical tool has added to some anxiety in the broader market, especially as Chuck Schumer (D-N.Y.) said Senate Democrats would block the tariffs. “Donald Trump’s foolhardy tariffs have already driven up prices and damaged our economy, and now he is only making things worse. Senate Democrats will introduce legislation to block these tariffs before they do further damage to the American economy and our allies in Europe,” Schumer said in a statement to The Hill.

But despite the macro jolt, Bitcoin (BTC) remained relatively steady, hovering around $95,000 and down 0.3% over the last 24 hours. Derivatives data from Coinglass indicates leverage is still contained. Over the past 24 hours, total liquidations are at close to $100 million – a far cry from crisis-level unwinds seen back in October 2025. Trump’s Chinese tariff announcement on Oct. 10 caused the biggest ever liquidation event in the history of crypto markets, with $19.16 billion worth of positions getting wiped out. On Stocktwits, retail sentiment around Bitcoin remained in 'bullish' territory, as chatter around the apex cryptocurrency remained at 'normal' levels over the past day.

Read also: VanEck’s Mathew Sigel Confirms It Is Not Bearish On MSTR

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Sam_Altman_1200pi_resized_jpg_a180a65511.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_540198451_jpg_3e5f3d8ee7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202831815_jpg_e9c998f956.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_b1a99c6298.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243572319_jpg_90770a5e51.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_Social_logo_1200_Px_resized_jpg_86883cac04.webp)