Advertisement|Remove ads.

Why Is BMNR’s Stock In Focus After Ethereum’s Sharp Selloff?

- On-chain data showed two anonymous whale wallets that had been dormant for five years were reactivated and had accumulated over $100 million in ETH.

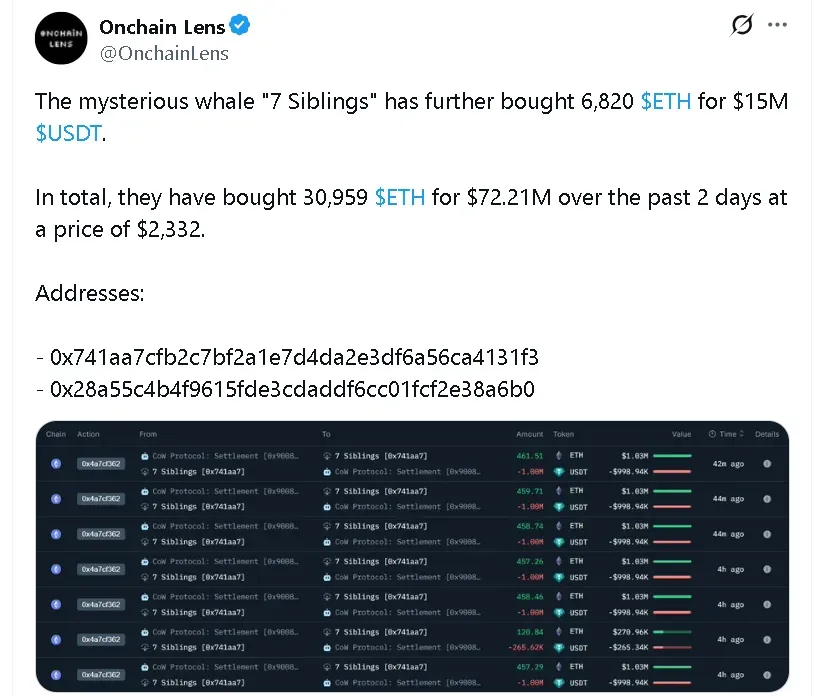

- The whale “7 Siblings” continued buying, accumulating over $72 million in ETH over two days.

- Trend Research also deposited more than $120 million in ETH on Binance, likely to sell and repay debt.

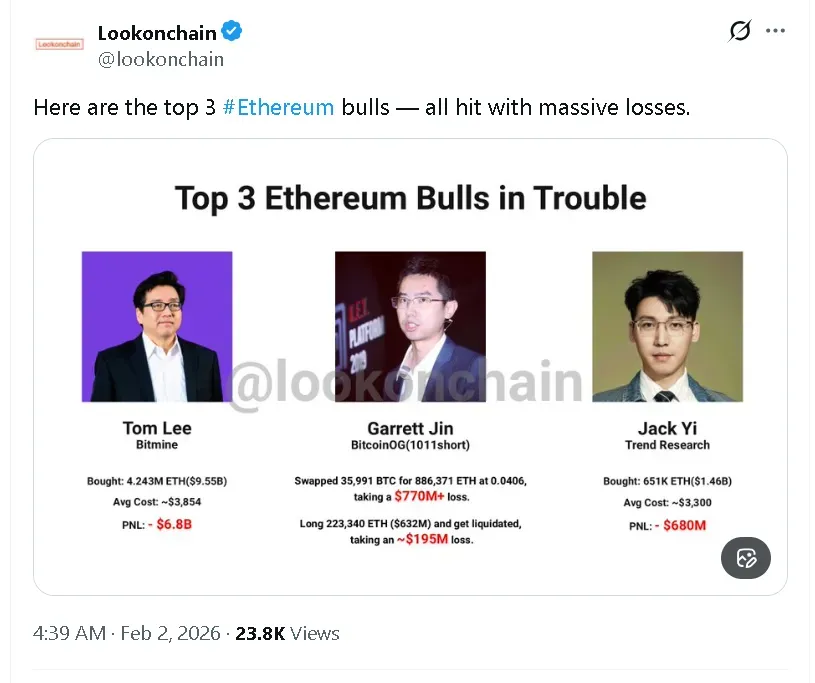

- Meanwhile, Ethereum bulls Tom Lee, Jack Yi, and Garrett Jin saw massive losses on Ethereum’s price dip.

Ethereum’s (ETH) selloff over the weekend alongside Bitcoin (BTC) weighed heavily on large corporate holders, with Bitmine Immersion Technologies (BMNR) chair Tom Lee facing an estimated $6.8 billion hit, while on-chain data showed crypto whales stepping in to buy the dip.

Ethereum’s price fell nearly 6% in the last 24 hours to around $2,200 at the time of writing. On Stocktwits, retail sentiment around the altcoin remained in ‘bearish’ territory, while chatter rose to ‘extremely high’ from ‘high’ levels over the past day.

The top three Ethereum bulls saw the value of their holdings plummet amid the crypto crash. Bitmine’s Tom Lee is sitting on an unrealized loss of around $6.8 billion, according to LookOnChain data, while Trend Research’s Jack Yi is $680 million in the red. Garrett Jin, an early Bitcoin investor, took a loss of nearly $1 billion.

BMNR’s stock was among the top trending tickers on Stocktwits with retail sentiment in ‘bearish’ territory and chatter at ‘normal’ levels over the past day as the share price fell over 10% in pre-market trade.

Dormant Wallets Wake Up To Buy Ethereum’s Dip

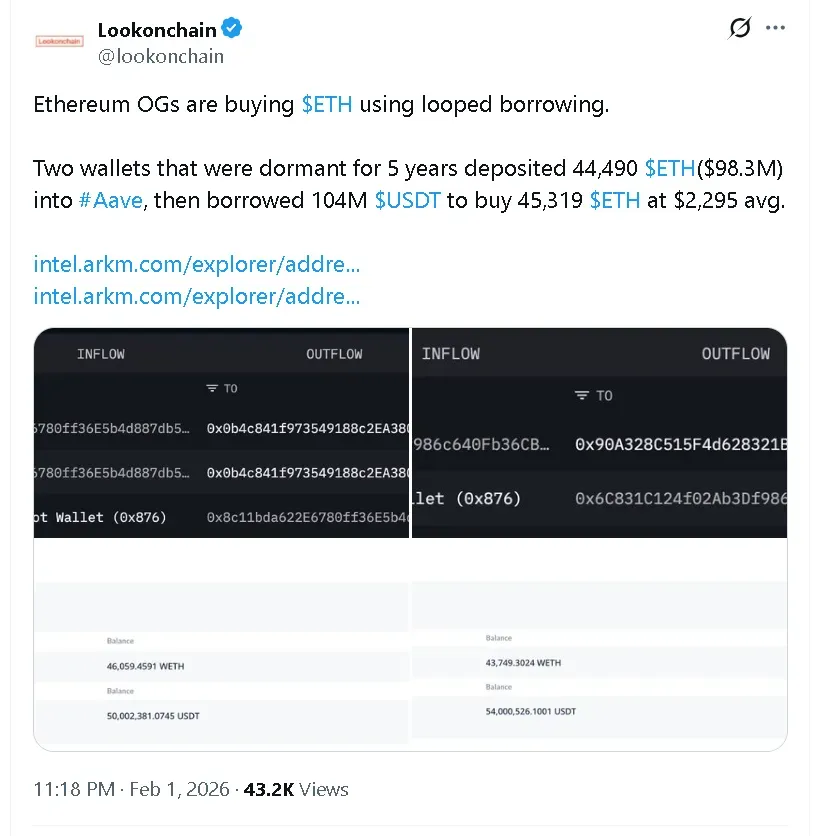

Blockchain data from Arkham Intelligence, flagged by LookOnChain, showed that two anonymous whale wallets that had been dormant for roughly five years reactivated over the weekend. The wallets deposited a combined 44,490 ETH, worth about $98.3 million, into Aave before borrowing roughly $104 million in USDT.

The borrowed stablecoins were then used to purchase 45,319 ETH at an average price of $2,295, indicating leveraged accumulation during the downturn rather than profit-taking.

Other Major Whales Add Ethereum Exposure Despite Price Weakness

The whale known as “7 Siblings” also added to its Ethereum position, purchasing an additional 6,820 ETH for about $15 million in USDT, according to data spotted by OnChainLens. Over the past two days, the entity has accumulated 30,959 ETH for a combined $72.2 million, at an average price of roughly $2,332.

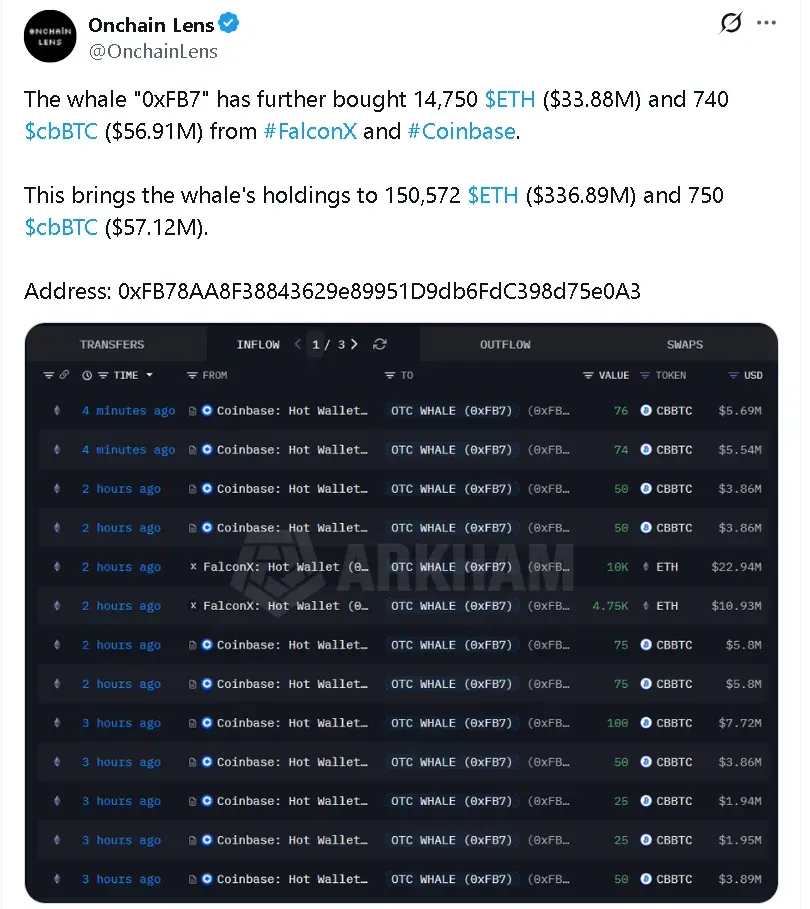

Crypto activity across other whale accounts also suggested continued appetite for Ethereum at current levels. Onchain Lens disclosed that a wallet identified as “0xFB7” purchased another 14,750 ETH, valued at about $33.9 million, alongside 740 cbBTC worth roughly $56.9 million from FalconX and Coinbase (COIN).

Following the purchases, the wallet’s holdings rose to 150,572 ETH, valued at approximately $336.9 million, and 750 cbBTC, valued at approximately $57.1 million.

Trend Research was also spotted sending 20,000 ETH worth roughly $43.9 million to Binance. In total, Trend deposited 53,588 ETH, valued at about $123.1 million, into the exchange. The transfers appeared tied to selling activity aimed at repaying an outstanding loan.

Is Ethereum’s Price Going To Rally?

While many analysts have flagged the weakness in Ethereum, some believe that it may be about to rally. Founder and the chief investment officer at MN Fund, Michael van de Poppe, stated that Ethereum’s price could rally more than 300% against Bitcoin (BTC) after gold’s recent record high of over $5,500 per troy ounce.

Crypto analyst Marc De Mesel also stated in a recent analysis that Ethereum is “not done” yet. He forecast that ETH and other altcoins could still have upside, even though this cycle has been disappointing so far.

The overall cryptocurrency fell 2.5% in the last 24 hours to $2.67 trillion. Bitcoin’s price was down 1.9%, trading at around $77,200 on Monday morning. On Stocktwits, retail sentiment around the apex cryptocurrency fell to ‘extremely bearish’ from ‘bearish’ territory with chatter at ‘extremely high’ levels.

Read also: Why Crypto Is Crashing Has More To Do With Gold Than Binance Or ETFs, Raoul Pal Says

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2237441231_jpg_b3b4b09b87.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_blue_owl_capital_jpg_4d9954c2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553061_jpg_699278f844.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trump_media_and_technology_group_media_009b60f8cd.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HP_corporate_logo_resized_a2479d3136.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_terawulf_OG_jpg_a87a18705d.webp)