Advertisement|Remove ads.

Retail Traders Bet On XRP To Beat SOL, ADA, LTC To An ETF Approval

Retail traders have made their pick — Ripple (XRP) is the clear frontrunner to be the first altcoin ETF to gain approval from the U.S. Securities and Exchange Commission (SEC), ahead of Litecoin (LTC), Solana (SOL) and Cardano (ADA).

XRP was the top trending ticker on Stocktwits on Thursday morning, reflecting heightened investor interest.

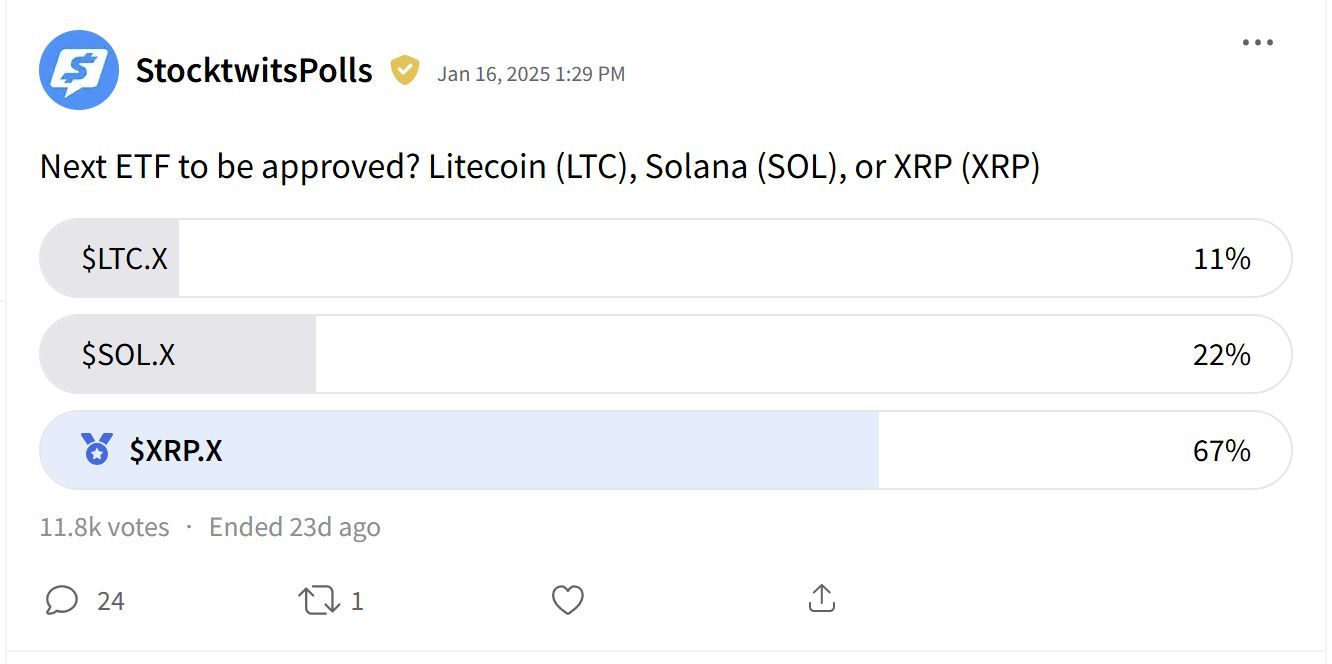

A January survey showed that 67% of investors picked XRP as the most likely non-Bitcoin (BTC) cryptocurrency to receive regulatory approval, far outpacing Solana (22%) and Litecoin (11%).

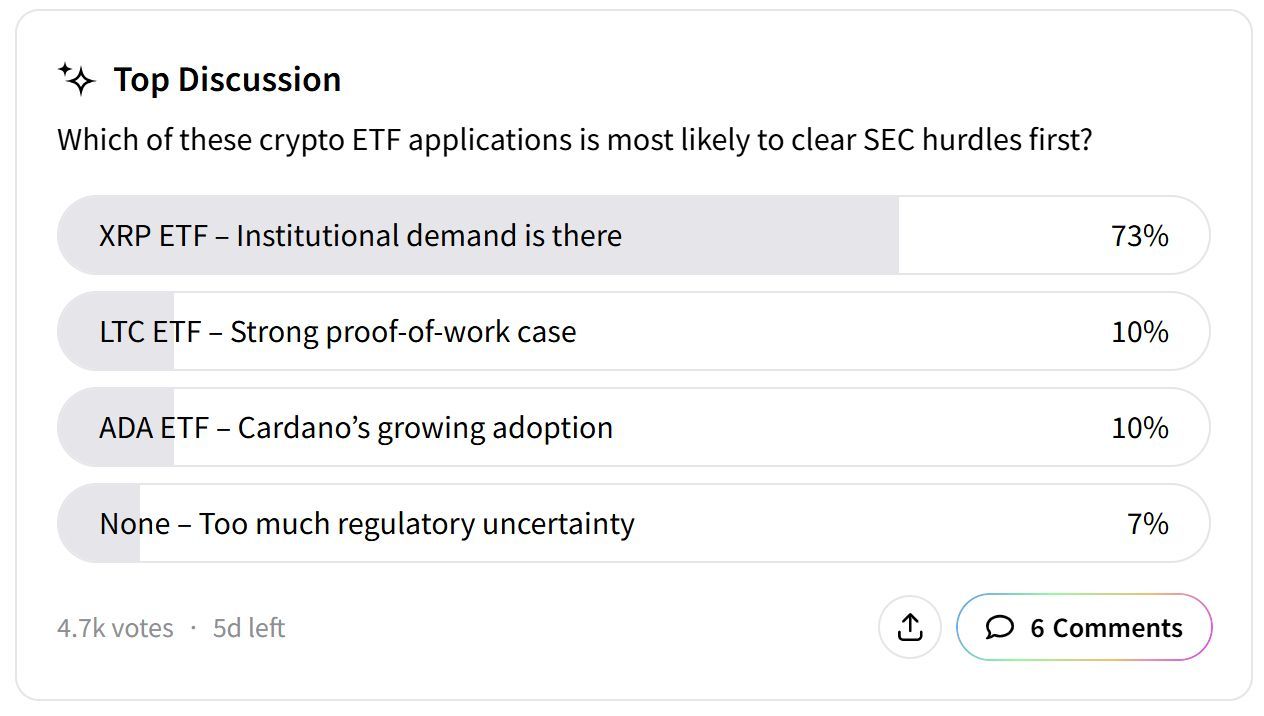

A second poll reinforced this view, with 73% of respondents citing XRP’s strong institutional demand as its biggest advantage.

The bullish outlook comes as the SEC formally acknowledged filings for Grayscale’s proposed XRP and Dogecoin ETFs, a move that signals a notable shift in regulatory posture.

The agency has an ongoing lawsuit against Ripple, arguing that XRP was an unregistered security.

The SEC’s acknowledgment of Grayscale’s filing has fueled speculation about a potential resolution to Ripple’s ongoing legal battles, including whether the SEC will withdraw its appeal against a court ruling on the programmatic sales of XRP.

This comes on the heels of Binance and the SEC recently filing a joint motion seeking a 60-day stay earlier this week, raising further questions about shifting regulatory dynamics.

Unlike competitors such as Solana, Cardano, and Litecoin, XRP has seen significant institutional adoption, reinforcing investor confidence in its candidacy for an ETF.

Solana, a dominant force in decentralized finance (DeFi) and non-fungible tokens (NFTs), continues to grapple with concerns over network stability and regulatory classification.

Litecoin, as a proof-of-work (PoW) cryptocurrency, benefits from a strong security record but lacks the same level of institutional adoption as XRP.

Meanwhile, the SEC’s willingness to review ETF applications for Solana, Litecoin, and Dogecoin signals a broader policy shift.

Under the Trump administration’s leadership, the agency appears more open to crypto-linked financial products than in previous years when approvals were largely restricted to Bitcoin.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: XRP, DOGE Rally As SEC Acknowledges Grayscale ETF Filings – Ripple Leads Retail Buzz

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2166123192_jpg_1bb818cd90.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Civic_resized_jpg_120d89cac4.webp)