Advertisement|Remove ads.

XRP Jumps 11% On ETF Inflows While Analysts Factor In A Bitcoin Breakout

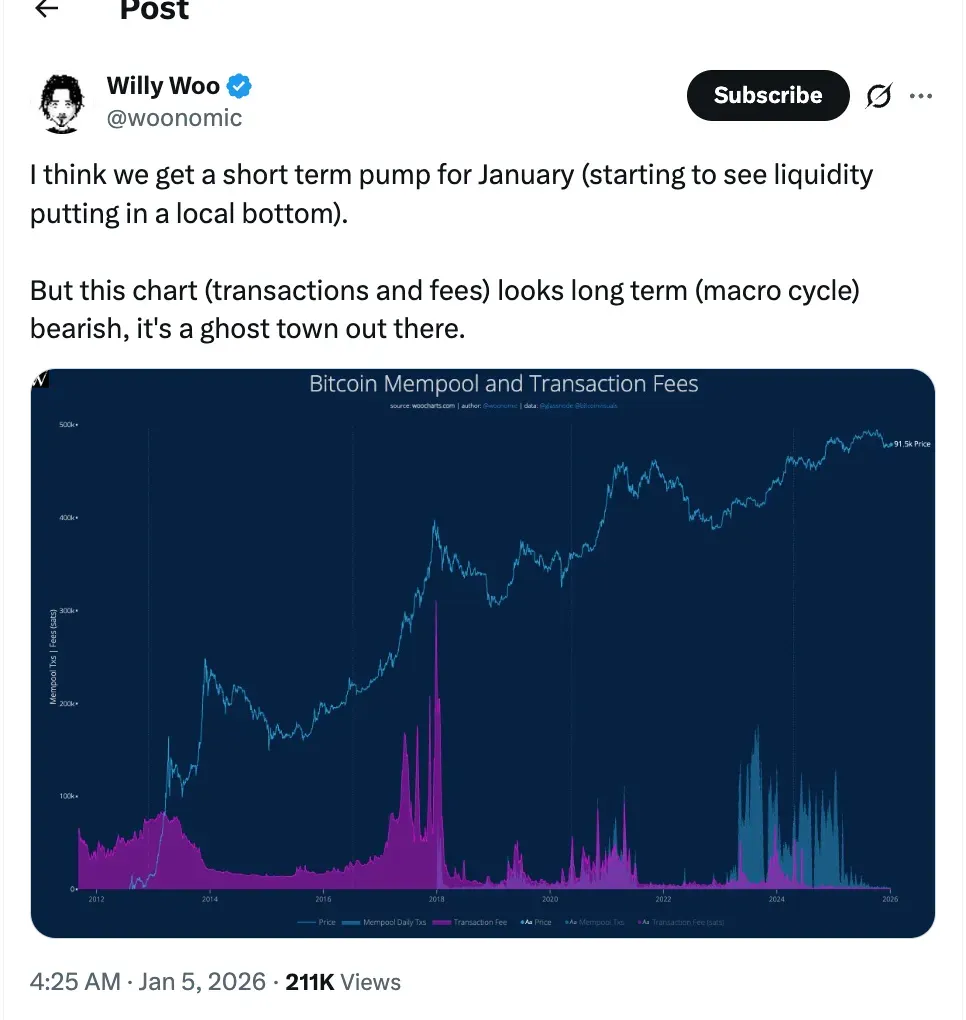

- Analyst Willy Woo warned that while January could see a short-term bounce from liquidity-driven bottoms, long-term macro signals point to a bearish setup.

- Bitfinex analysts call the capture of Venezuelan President Nicolás Maduro by U.S. forces a “major geopolitical shock” that affected energy markets and digital assets immediately.

- XRP led the rally among major altcoins and was the top trending crypto ticker on Stockwits at the time of writing, trading around $2.40.

Crypto markets closed in the green on Monday with upside action largely dominated by long liquidations, as analysts stay divided on Bitcoin’s (BTC) bullish momentum.

Bitcoin’s price was trading at $93,570, gaining 0.7% over the prior 24 hours and continuing its upward trend since last week. According to CoinGlass data, Bitcoin saw nearly $185.9 million in liquidations alone, and almost $169.7 million in shorts. The apex cryptocurrency saw an intra-day high of 94,634.23. However, analysts remained cautiously constructive.

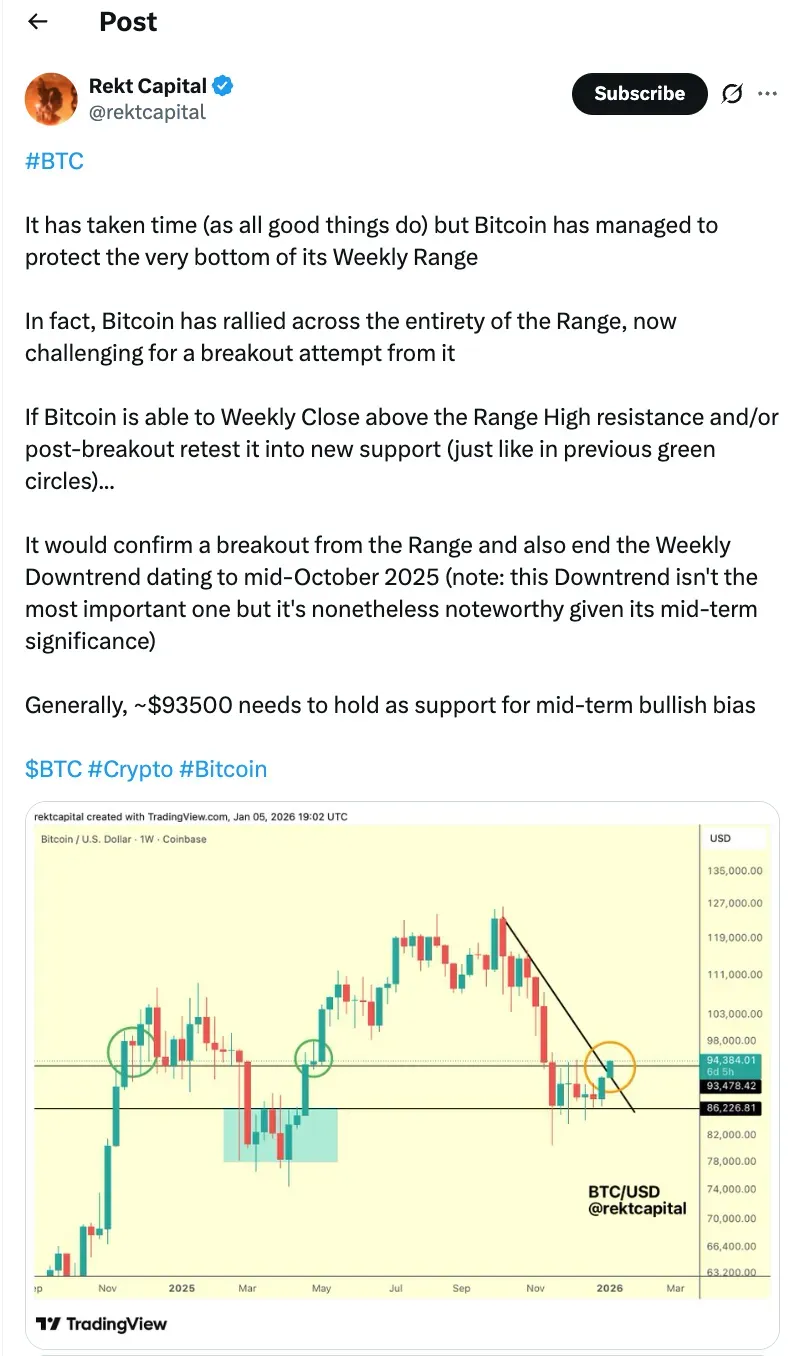

CoinGlass data posted on X indicated a huge increase in realized cap from whales, indicating that new money is entering the market. Rekt Capital believes that it is crucial to maintain a mid-term bullish bias and confirm a sustained breakout.

However, not all analysts were bullish on Bitcoin. For instance, Willy Woo alerted to the potential for a short-term bounce in January as liquidity creates a local bottom, but added that on-chain behaviour such as transaction fees still appears to be bearish from a long-term macro perspective. On Stocktwits, retail sentiment around Bitcoin remained in ‘extremely bullish’ territory, with chatter improving from ‘normal’ levels to ‘high’ levels over the past day.

Bitfinex analysts said in an email that the news reports of Venezuelan President Nicolás Maduro being captured by U.S. forces was a “major geopolitical shock” that has had an immediate impact on energy markets and digital assets. They added that a return of Venezuelan oil to world markets could “reduce electricity costs” for energy-intensive businesses such as Bitcoin mining over time. In addition to energy, the analysts said the event could affect crypto prices through shifts in risk tolerance more broadly.

Altseason Could Lead To Bitcoin Breakout, Says Analyst

Analyst Mercury X said on X that an altseason might be on the way as some altcoins have broken higher on higher timeframes, which the analyst sees as an early signal for Bitcoin’s bull run too.

Ethereum (ETH) was trading at around $3,212, also an increase of about 0.8% in the past 24 hours. ETH liquidations were more modest at a little over $78.3 million and were overwhelmingly short-led, implying leverage-driven continuation as opposed to a clear trend reversal. On Stocktwits, retail sentiment around Ethereum remained in 'bullish’ territory, with chatter levels improving from ‘normal’ to ’high’ over the past day.

XRP Moves The Momentum

Among the large-cap coins, Ripple’s XRP (XRP) was the outperformer in the market, closing at around $2.40 and up 11.8%. XRP saw liquidations of over $30.0 million with shorts. XRP was trending at ‘number 1’ on Stocktwits, as retail sentiment remained an ‘extremely bullish’ zone, with chatter levels increasing from ‘high’ to ‘extremely high’ over the past day. XRP's bullish momentum is being assisted by spot XRP ETFs, which have the highest daily volume since they launched in November, bringing in the total traded volume to $1.65 billion, as per SoSoValue data.

Solana (SOL) traded at around $137.6, up 1.1%, and about $11.1 million in liquidations were led by shorts. On Stocktwits, retail sentiment around Solana was in the ‘neutral’ zone, with chatter levels changing from ‘normal' to ‘high’ over the past day.

Dogecoin (DOGE) was trading just below $0.152, climbing 0.3%, with about $3.6 million of liquidations, favoring shorts. On Stocktwits, retail sentiment around Dogecoin remained in ‘extremely bullish’ territory, accompanied by ‘extremely high’ levels of chatter over the past day.

Cardano (ADA) was at $0.427, gaining 6.0% and seeing about $2.3 million in liquidations. On Stocktwits, retail sentiment around Cardano improved from ‘bullish’ to ‘extremely bullish’ zone over the past day, as chatter levels remained at ‘high’ levels.

Binance Coin (BNB) gained about 0.6% to $905.7 as liquidations remained rather muted around $775,000, indicating a more spot-driven move. On Stocktwits, retail sentiment around Binance Coin remained in ‘extremely bullish’ territory, accompanied by ‘normal’ levels of chatter over the past day.

TRON (TRX) fell to $0.2927, up 0.5%, with liquidations at $17,000 in the last 24 hours, meaning limited speculation compared to other large-cap tokens. On Stocktwits, retail sentiment around Tron remained in ‘bullish’ territory, as chatter levels improved from ‘normal’ to ‘high’ over the past day.

In the last 24 hours, the aggregate liquidations have risen to around $415.9 million, and shorts have taken a significant hit.

Read also: A $7 Million Crypto Transfer From Tron To Ethereum Shows Signs Of Pig-Butchering Scam

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_capitol_market_OG_jpg_8111684a8f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)