Advertisement|Remove ads.

Altcoins XRP, LTC Gains Outpace Bitcoin As Crypto Market Awaits Release Of FOMC Minutes

The cryptocurrency market advanced on Wednesday, with major digital assets posting gains ahead of the release of the Federal Open Market Committee (FOMC) minutes.

At its first meeting of 2025, the FOMC voted unanimously to keep the benchmark rate unchanged at 4.25%-4.5%.

In its latest statement, the central bank removed previous language suggesting inflation had "made progress" toward its 2% target.

Instead, officials noted that price pressures "remain elevated."

During U.S. afternoon trading, all top 20 cryptocurrencies trended in the green.

Ripple (XRP) led the rally among the top ten tokens by market capitalization, surging more than 7% to $2.66.

Meanwhile, Bitcoin (BTC) and Ethereum (ETH) prices saw more measured increases. Bitcoin increased 2.5% in the past 24 hours to $96,400 levels, while Ether advanced 3.8% to $2,700.

Among the top 20 cryptocurrencies by market capitalization, Litecoin (LTC) and Hedera (HBAR) climbed around 10%, while Sui (SUI) gained over 9%.

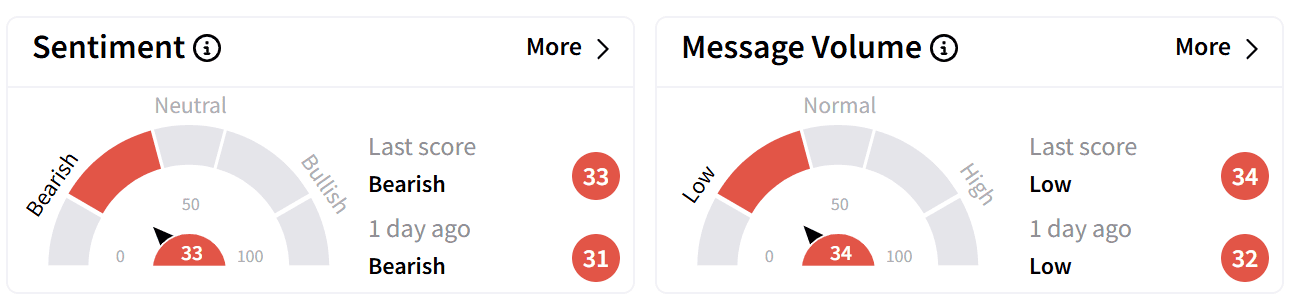

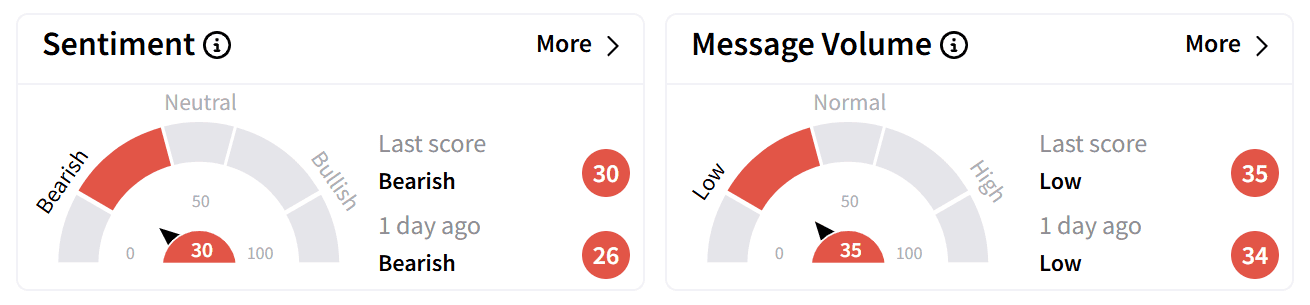

Despite XRP’s sharp rally, retail sentiment on Stocktwits continued to trend in the ‘bearish’ territory, with chatter at ‘low’ levels.

Bitcoin also saw ‘bearish’ retail sentiment, with message volumes at ‘low’ levels.

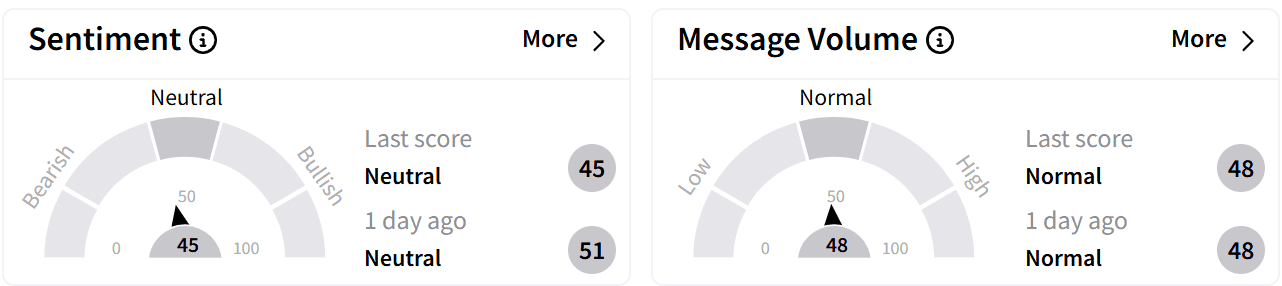

However, retail traders were a little more optimistic about Ethereum with sentiment in the ‘neutral’ territory.

Fed Chair Jerome Powell, speaking at a post-meeting press conference, reinforced that the central bank is in no rush to adjust monetary policy.

Earlier in the week, Philadelphia Fed President Patrick Harker and Atlanta Fed President Raphael Bostic both signaled a cautious approach, suggesting that the next rate cut may be delayed to allow more time for economic data to develop.

With inflation concerns still lingering, crypto traders are closely monitoring Fed policy shifts, as higher interest rates typically weigh on risk assets like cryptocurrencies.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Litecoin Tops Crypto Gains As Open Interest Hits 3-Year High: Retail Bullish On ETF Approval

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_credo_technology_resized_cdb4311141.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_changpeng_zhao_binance_CEO_OG_jpg_1f2a158765.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_iran_natanz_nuclear_facility_jpg_ca08028936.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234618957_jpg_1c670c00ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)