Advertisement|Remove ads.

Why Is 374Water Stock Rising Today?

- The project aims to eliminate per- and polyfluoroalkyl substances (PFAS) from biosolids and water treatment systems.

- Earlier, the company projected its 2026 revenue to be in the $6 million and $8 million range.

- Last week, 374Water also announced a partnership with The Cedar Rapids Water Control Pollution Facility (CRWPCF) and Brown and Caldwell to execute a project to destroy biosolids containing PFAS.

Shares of 374Water Inc. (SCWO) soared more than 22% on Tuesday morning after the company announced it had been awarded a Waste Destruction Services (WDS) project for the City of St. Cloud, Minnesota.

The WDS project aims to eliminate per- and polyfluoroalkyl substances (PFAS) in biosolids and water treatment residuals. The project was delivered by the Legislative-Citizen Commission on Minnesota Resources (LCCMR) and the state’s Environment and Natural Resources Trust Fund (ENTRF), the company stated.

The ENTRF is a permanent, dedicated fund in the Minnesota state treasury. Since 1991, about $875 million from the ENRTF has been spent on over 1,800 environmental projects.

374Water is a global industrial technology and services company that provides innovative solutions for wastewater treatment and waste management in the industrial, municipal, and federal markets.

airSCWO Technology

The award underscores the growing demand for 374Water’s innovative airSCWO technology, which destroys harmful pollutants during water treatment, helping the firm generate more revenue.

“With the recent announcements of revenue-generating service and capital equipment sales, we are projecting 2026 revenue to be in the $6 million and $8 million range,” said its interim President and CEO, Stephen Jones, during the firm’s recently reported third quarter (Q3) results.

He added that the firm is focused on successful destruction of PFAS and other waste streams using our AirSCWO system in current project deployments and on accelerating the conversion of a growing pipeline of opportunities.

Last week, 374Water also announced a partnership with The Cedar Rapids Water Control Pollution Facility (CRWPCF) and Brown and Caldwell to execute a project to destroy biosolids containing PFAS.

How Did Stocktwits Users React?

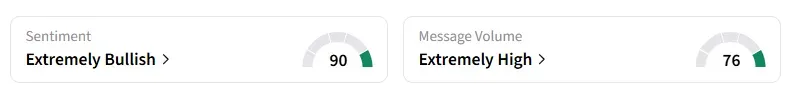

Retail sentiment around the SCWO trended in “extremely bullish” territory amid “extremely high” message volume.

Shares of 374Water have lost over 68% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)