Advertisement|Remove ads.

3M To Return At Least $10B Cash To Shareholders, Provides Medium Term Outlook Ahead Of Investor Day: Retail Keeps Fingers Crossed

Shares of industrial conglomerate 3M Co (MMM) rose 1% on Wednesday morning after the company announced a massive cash return to shareholders and provided a glimpse into its 2026 and 2027 outlook.

3M said it would return at least $10 billion in cash to shareholders over 2027.

For 2026 and 2027, the company expects its organic sales growth to outperform macro while anticipating a high single-digit earnings per share (EPS) growth annually.

The company said that by 2027, it would record an operating margin of approximately 25%.

CEO William Brown said, in prepared remarks, that the company is reiterating its 2025 guidance, and its medium-term outlook provides a clear path to reinvigorate top-line growth and drive operational performance.

“I am confident that our new performance-based culture and 3M eXcellence operating system allow us to capitalize on opportunities to deliver value for customers and shareholders,” he said.

During 3M’s fourth-quarter earnings announcement, the company projected a 2025 adjusted total sales growth of 0.5% to 1.5%, reflecting adjusted organic sales growth of 2% to 3%.

The company expects adjusted EPS in the range of $7.60 to $7.90, while adjusted operating cash flow is anticipated at $5.2 billion to $5.3 billion, contributing to approximately 100% adjusted free cash flow conversion.

The company is hosting its 2025 Investor Day on Wednesday in St. Paul, Minnesota.

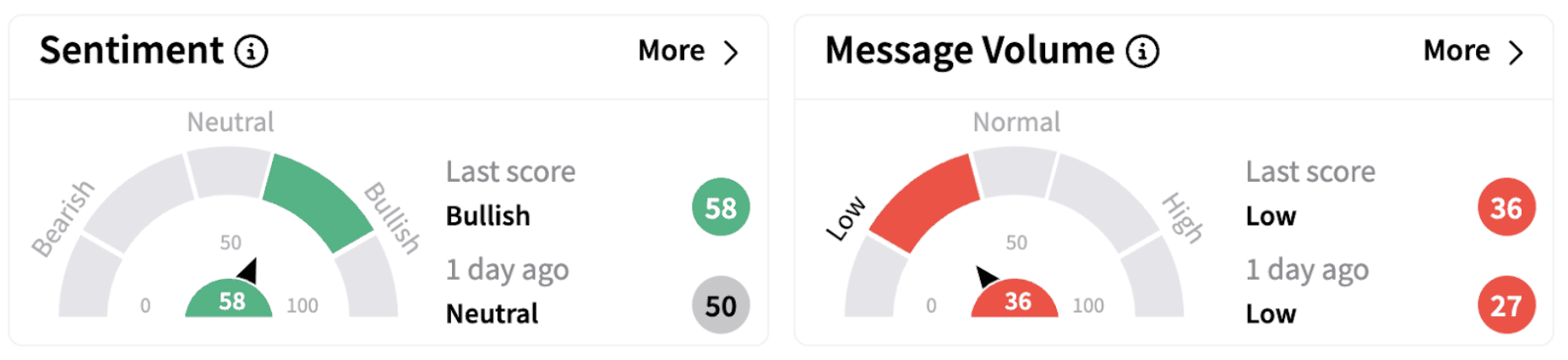

Meanwhile, on Stocktwits, retail sentiment climbed into the ‘bullish’ territory (58/100) from ‘neutral’ a day ago.

3M shares have gained over 14% this year and over 92% over the past year.

Also See: Unusual Machines Stock In Spotlight After Orders From Red Cat Holdings: Retail Cheers The Deal

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194650023_jpg_2af2244b5a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathie_wood_OG_2_jpg_c5be4c4636.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233055049_jpg_0a316df698.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sandisk_jpg_920fcc1fc3.webp)