Advertisement|Remove ads.

Unusual Machines Stock In Spotlight After Orders From Red Cat Holdings: Retail Cheers The Deal

Shares of drone component manufacturer Unusual Machines (UMAC) were in the spotlight on Wednesday after the company announced it had secured motor orders from Red Cat Holdings (RCAT).

This is Unusual Machines’ first partnership to develop motors built to meet the specific requirements of a U.S. drone producer. The company said Red Cat would use three motor variants for one of its platforms designed for government and commercial applications.

The company further highlighted that the motors will be among the first produced in its U.S.-based manufacturing facility, which is currently under development.

Meanwhile, production will occur in a partnered facility, with Unusual Machines expecting to begin deliveries by the end of March.

Unusual Machines CEO Allan Evans said the company aims to provide high-performance motors to American drone manufacturers at cost parity with the Chinese-made alternatives.

"Red Cat's decision to source motors from Unusual Machines underscores the demand for a domestic supply chain that supports national security and regulatory compliance,” he said.

This development comes as the U.S. government has tightened restrictions on Chinese drone technology. As a result, the demand for American-made alternatives is expected to grow.

Unusual Machines has been in the news lately after the company signed a binding agreement to acquire Aloft Technologies, Inc., an FAA-approved provider of unmanned aerial system services to enterprise, public safety, and government customers.

The acquisition, which would be almost all-in-stock, has been valued at $14.5 million.

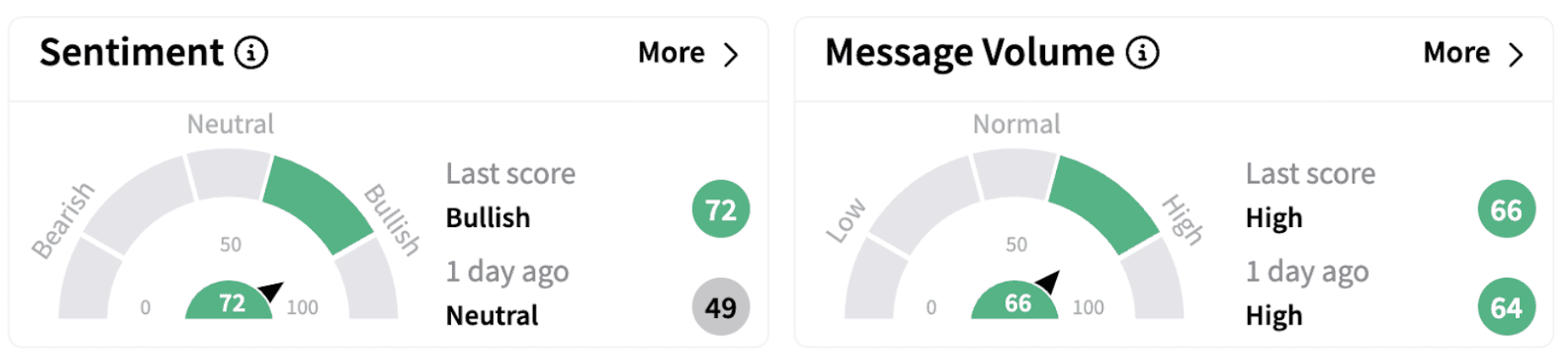

Following the announcement, retail sentiment on Stocktwits climbed into the ‘bullish’ territory (72/100) from ‘neutral’ a day ago.

UMAC shares have lost over 43% in 2025 but have gained over 210% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_hut8_OG_jpg_66d77fe261.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_klarna_OG_jpg_830d4c6bf5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194650023_jpg_2af2244b5a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathie_wood_OG_2_jpg_c5be4c4636.webp)