Advertisement|Remove ads.

5Paisa Earnings Preview: SEBI RA Rohit Mehta Sees Support At ₹292

Shares of 5Paisa Capital have fallen nearly 14% over the past year, raising anticipation ahead of the company’s first-quarter FY26 earnings due Tuesday.

SEBI-registered research analyst Rohit Mehta reviewed both technical and fundamental trends.

Mehta pointed out that promoter ownership held steady at 32.75% in March 2025, barely changed from 32.76% in December.

Foreign institutional investors and domestic institutional investors holdings also remained largely unchanged at 21.57% and 0.25%.

On the earnings front, Mehta said that while fourth-quarter (Q4) sales dropped sharply by 37% year-over-year, the company still managed to grow operating profit by 24%. Profit before tax jumped more than threefold, and earnings per share surged over 200%.

Sequentially, however, Q4 FY25 sales fell 16.47%, operating profit dropped 30%, profit before tax declined 40.91%, and EPS fell 37.79%.

Among the positives, Mehta noted that 5Paisa Capital has reduced its debt burden, delivered a five-year compound annual growth rate (CAGR) of 60.4%, and maintained a 10-year median sales growth rate of 16.7%.

On the downside, Mehta pointed out the absence of dividends, relatively low promoter shareholding, average return on equity of 10.9% over the past three years, and contingent liabilities totaling ₹460 crore.

From a technical perspective, Mehta identified ₹292 to ₹310 as a support zone and pegged key resistance at ₹575.30 and ₹758.35, the latter being the all-time high from January 2024.

The stock is currently trading around ₹421.70, about 44% below its peak, and Mehta observed a rounding bottom pattern in formation.

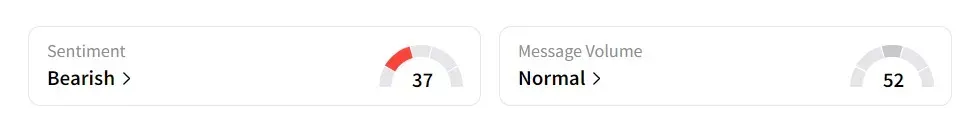

On Stocktwits, retail sentiment was ‘bearish’ amid ‘normal’ message volume.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)