Advertisement|Remove ads.

These 5 Tech Stocks Led Retail Interest Gains On Stocktwits Last Week

The broader market was mostly lower in the week ended Feb. 28, with the Donald Trump administration’s tariffs and macro concerns weighing down on sentiment. The S&P 500 Index - a broader market gauge closed nearly 1% lower for the week.

Against the backdrop, the following tech companies were among those witnessed a surge in follower count on the Stocktwits platform over the past seven days:

- Urgent.ly, Inc. (ULY) - 39% jump in retail following

Vienna, Virginia-based Urgent.ly’s shares jumped nearly 52% in the week ended Feb. 28 as the nano-cap company announced an agreement with its lenders, resulting in significant capital structure improvements.

The company also said it has entered into a new credit agreement for an asset-based revolving credit facility for up to $20 million with MidCap Financial. It expects to use the financing to repay existing indebtedness to its first lien lenders and advance its mission to transform the legacy roadside assistance market.

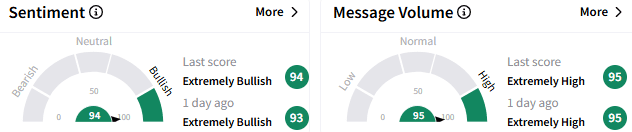

Retail sentiment toward Urgent.ly stock remains ‘extremely bullish’ (94/100) and the message volume stayed ‘extremely high.’

Urgent.ly provides a mobility assistance software platform for roadside assistance.

- Banzai International Inc. (BNZI) - 25% jump in retail following

Bainbridge Island, Washington-based Banzai provides data-driven marketing and sales solutions for various businesses across the globe. Its shares fell to a weekly low of $1.20 on Thursday before soaring 13.39% on Friday. Yet, it ended the week down by about 6%.

On Tuesday, Banzai announced the launch of CreateStudio 4.0, the latest version of its video creation app developed by its Vidello subsidiary. This app lets users produce eye-catching 3D character animations for social media and websites.

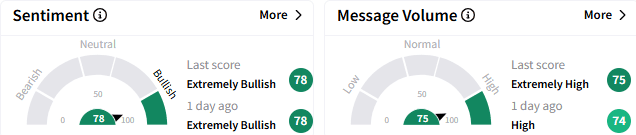

Banzai stock drew ‘extremely bullish’ sentiment (78/100) from among Stocktwits users, with the message volume improving to an ‘extremely high’ level.

- Porch Group, Inc. (PRCH) - 12% jump in retail following

Seattle, Washington-based Porch is a vertical software and insurance platform provider. Porch stock jumped over 61% last week after the company announced that it swung to a profit on a reported basis. Quarterly adjusted earnings before interest, taxes and depreciation (EBITDA) also improved year over year (YoY) to a record $41.8 million.

The company raised its 2025 guidance, including an adjusted EBITDA of $60 million at the midpoint.

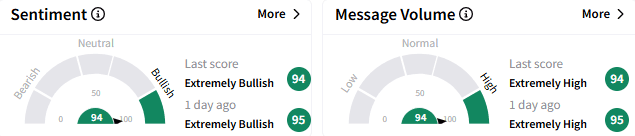

Retail sentiment toward Porch stock stayed ‘extremely bullish' (94/100), with the message volume remaining ‘extremely high.’

- Grindr, Inc. (GRND) - 8% jump in retail following

Grindr operates social network and dating applications for the lesbian, gay, bisexual, transgender, and queer (LGBTQ) communities worldwide. The West Hollywood, California-based company’s stock climbed 2% last week.

The company is scheduled to report its fourth-quarter results after the market closes on March 5.

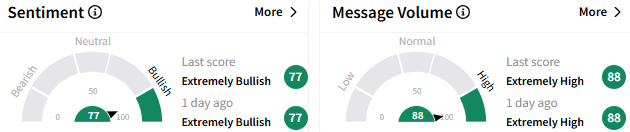

On Stocktwits, sentiment toward Grindr stock stayed ‘extremely bullish’ (77/100), and the positive sentiment was accompanied by ‘extremely high’ message volume.

- DoubleVerify Holdings, Inc. (DV) - 8% jump in retail following

DoubleVerify stock plummeted 36% on Friday after the digital media measurement, data, and analytics platform provider announced disappointing results for the fourth quarter of the fiscal year 2024 and issued mixed guidance.

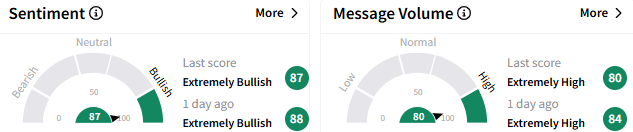

However, retailers maintained their ‘extremely bullish’ view (87/100), and retail chatter also stayed at an ‘extremely high’ level.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218181377_jpg_f2dccc3db9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2245017747_jpg_f783731632.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_China_i_Phone_jpg_bcedab655a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_American_Airlines_Getty_4d3d704837.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_sabre_resized_jpg_fa5aa35db6.webp)