Advertisement|Remove ads.

Zscaler, Pure Storage, PSQ Holdings And More: 5 Tech Stocks That Saw Brisk Activity On Stocktwits Last Week

The S&P 500 Index fell over 3% in the week ended March 7, with the index posting declines for a third straight week. President Donald Trump’s tariffs and the mixed data that confounded the Federal Reserve’s rate outlook weighed down on the market.

Here’s a compilation of five tech stocks that saw brisk message volume on the Stocktwits platform last week:

PSQ Holdings, Inc. (PSQH) - 500% increase in message volume

West Palm Beach, Florida-based PSQ Holdings is the parent company of marketplace operator and fintech firm PublicSquare. PSQ Holdings stock posted a weekly gain of 1.5%, defying the broader market slump, although in the absence of any meaningful catalysts.

The company has scheduled its earnings release for the fourth quarter of the fiscal year 2024 for Thursday. It also announced that CEO Michael Seifert, and President of Fintech Brian Billingsley will participate in a fireside chat at the upcoming 37th Annual Roth Investor Conference in Dana Point, California.

In December, rumors about Donald Trump’s son Donald Trump Jr. joining the company's board made the rounds, sending its shares sharply higher.

Zscaler, Inc. (ZS) - 400% increase in message volume

San Jose, California-based cybersecurity vendor Zscaler reported forecast-beating results for the second quarter of fiscal year 2025 last week. The company also raised its third-quarter guidance.

The stock gained more than 6% over two sessions following the print.

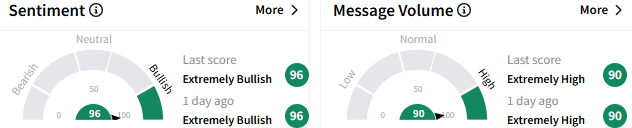

On Stocktwits, retail’s sentiment toward Zscaler stock stayed ‘extremely bullish,’ with the buoyant mood accompanied by ‘extremely high’ volume.

Digital Tribune, Inc. (APPS) - 350% increase in message volume

Austin, Texas-based Digital Tribune is an operator of a mobile growth platform for advertisers, publishers, carriers and device original-equipment manufacturers.

The small-cap stock posted a weekly loss of nearly 15% as insiders have been on a selling spree since the company released its earnings report for the third quarter of the fiscal year 2025 on Feb. 5.

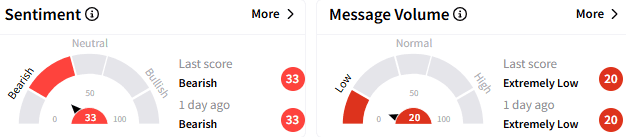

Retail remained ‘bearish’ (33/100) on Digital Tribune stock, with the message volume trickling down to ‘extremely low’ levels by the end of the week.

Pure Storage, Inc. (PSTG) - 200% increase in message volume

Shares of Santa Clara, California-based data storage solutions provider Pure Storage were volatile last week. The stock started the week on a sour note, extending the earnings-induced losses from Feb. 27.

After rebounding from the losses on Tuesday and extending the gains on Wednesday, the stock retreated on Thursday. It climbed along with the broader market on Friday, and yet settled the week down over 6%.

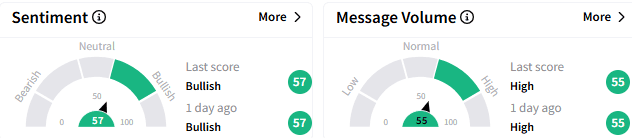

On Stocktwits, sentiment toward Pure Storage stock stayed ‘bullish’ (57/100) and the message volume also remained ‘high.’

Tuya, Inc. (TUYA) - 200% increase in message volume

Hangzhou, China-based Tuya provides a purpose-built Internet of Things (IoT) cloud development platform in China. Tuya stock added about 18% last week.

At the Mobile World Congress 2025, the company announced a partnership with Vietnamese telecom company Viettel Telecom and T3 Technology. The partnership aims to accelerate the development of the region's smart home ecosystem by leveraging Tuya's Cube Cloud solution and the combined expertise of all three companies.

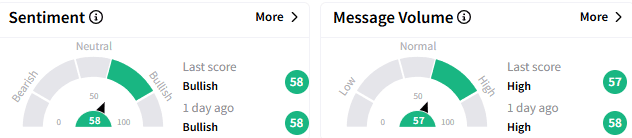

Retail held a ‘bullish’ view (58/100) on the stock, and message volume stayed at ‘high levels.’

For updates and corrections email newsroom[at]stocktwits[dot]com.

Read Next: Oracle’s Q3 Earnings On Tap As Stock Struggles to Break Out Of Recent Rut: Retail Remains Bearish

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathiewood_OG_jpg_a3c8fddb3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Micron_jpg_7058d4986a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2249765235_jpg_8d9471024c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2185805420_fotor_2025011795638_6fbb0bb63f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_jpg_64b4ea4fc0.webp)