Advertisement|Remove ads.

Pure Storage Stock Tumbles 12% Premarket To Head Toward 3-Month Low Despite Q4 Beat: Retail Scrambles To Buy The Dip

Pure Storage, Inc. (PSTG) shares slid sharply in Thursday’s premarket session despite the data storage solutions provider reporting better-than-expected fiscal year 2025 fourth-quarter results and in-line guidance. Investors apparently did not take kindly to the sequential slowdown in key operational metrics.

The Santa Clara, California-based company reported fourth-quarter earnings per share (EPS) of $0.45 compared with the year-ago period’s $0.50 per share. However, the bottom-line result exceeded the consensus estimate of $0.42 per share.

Revenue climbed 11% year over year to $879.8 million, exceeding the $869.19-million consensus estimate and the company’s guidance of $782 million.

Subscription revenue grew 17% to $385.1 million, markedly slower than the 26% pace in the third quarter. The growth in the subscription annual recurring revenue (ARR) ($1.7 billion) slowed quarter over quarter (QoQ) to 21% from 26%.

The remaining performance obligation (RPO), another key operational metric, was $2.6 billion, with the growth slowing to 14% from 30% in the third quarter.

Non-GAAP operating income and margin were $153.1 million and 17.7%, respectively, compared to the guidance of $150 million and 19%.

Pure Storage CEO and Chairman Charles Giancarlo said, “Pure Storage delivered solid fourth quarter and full year results as we fundamentally transform data storage and management for enterprises and hyperscalers.”

He noted that the company enabled customers to modernize legacy storage architectures into enterprise data clouds with Fusion, its self-automating data storage delivery platform.

CFO Kevan Krysler noted that the company surpassed $3 billion in total annual revenue for the first time.

Pure Storage guided to a revenue of $770 million for the first quarter and $3.515 billion for the fiscal year 2026. Analysts, on average, estimate a revenue of $770.53 million for the quarter and $3.52 billion for the year.

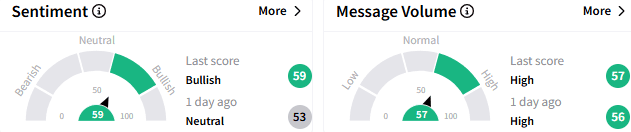

On Stocktwits, retail sentiment toward Pure Storage stock turned to ‘extremely bullish’ (79/100) from ‘bullish’ a day ago. The message volume perked up to an ‘extremely high’ level.

A bullish user said they bought the post-earnings dip, which they called a “knee-jerk” reaction, given the all-around beats

Pure Storage stock plunged 12.83% in premarket trading to $54.43, marking the lowest level since early December. Ahead of the premarket plunge, the stock gained 1.6% for the year-to-date period.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2177851484_jpg_b969f68c05.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)