Advertisement|Remove ads.

Advance Auto Parts Stock Rises As Cost-Cut Drive Outshines Surprise Q3 Loss: Retail Holds Strong

Shares of Advance Auto Parts Inc. ($AAPL) rose nearly 7% early on Thursday as a plan to close hundreds of stores and other belt-tightening measures overshadowed a surprise third-quarter loss.

The auto parts retailer revealed plans to shutter more than 500 corporate stores, exit over 200 independent locations, and close four distribution centers as part of a major restructuring effort.

Advance Auto Parts’ Q3 results were impacted by the recent $1.5 billion sale of its Worldpac unit to private equity firm Carlyle, with financials reported on a continuing operations basis.

Net sales declined 3.2% year-over-year to $2.15 billion, missing the FactSet consensus of $2.62 billion, which had included discontinued operations.

Comparable-store sales fell 2.3%, underperforming expectations for a 1.7% decline.

The company posted a net loss of $6 million, or $0.10 per share, for the quarter ending Oct. 5, significantly lower than a loss of $62 million, or $1.04 per share, recorded a year earlier.

On an adjusted basis, AAP reported a loss of $0.04 per share, compared to analysts’ forecast for a profit of $0.49. This marks the seventh consecutive quarter that Advance Auto Parts has missed on earnings per share (EPS) estimates.

CEO Shane O’Kelly expressed optimism about the company’s strategic actions, stating, “We are charting a clear path forward and introducing a new three-year financial plan, with a focus on executing core retail fundamentals to improve the productivity of all our assets and to create shareholder value.”

Key elements of the new plan include: Closing 523 corporate stores and four distribution centers, while standardizing store operations and accelerating new store openings; Enhancing product availability, improving pricing strategies, and optimizing assortment management to boost gross margins; Consolidating distribution centers into 13 large facilities by 2026 and opening 60 market hubs by mid-2027 to streamline logistics.

The restructuring is expected to cost between $350 million to $750 million, including severance, lease terminations, and other expenses.

The company lowered its full-year 2024 guidance, now expecting an EPS loss of $0.60 to break even, compared to prior guidance of a profit of $2.00 to $2.50 per share.

Comparable store sales are expected to decline approximately 1%, down from earlier projections of flat to a 1% decline.

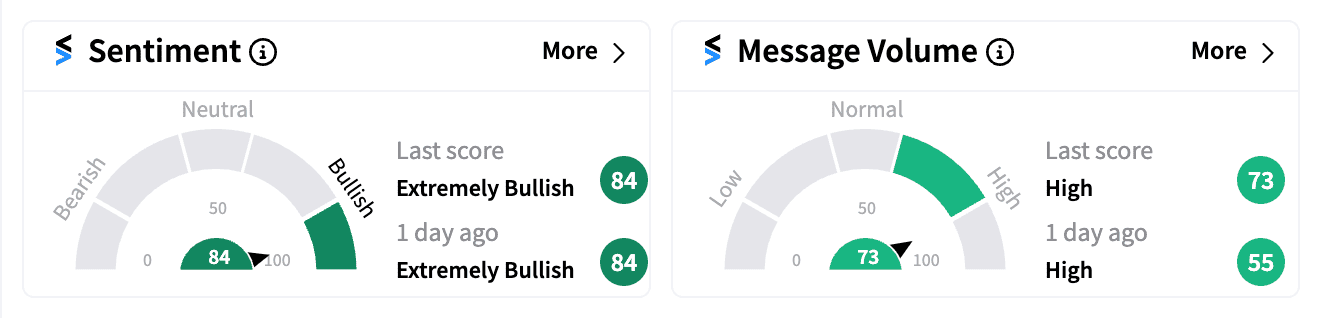

Despite the disappointing results and guidance, retail sentiment on Stocktwits remained ‘extremely bullish,’ with many users advocating for buying the dip.

Looking ahead to 2025, Advance Auto Parts targets net sales of $8.4 billion to $8.6 billion, with comparable store sales growth of 0.5% to 1.5%, aligning closely with the consensus of a 0.8% increase.

Year-to-date, AAP shares are down nearly 33%, as of Wednesday’s close, underperforming the broader market.

For updates and corrections, email newsroom@stocktwits.com

Read next: Disney Stock Set To Hit 6-Month Highs After Upbeat Earnings: Retail Gets More Bullish

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222180224_jpg_e3d1b42037.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_OG_jpg_64661e0152.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/04/423107720-2025-04-097432120fdfbcb42d2029e245986454-scaled.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233055049_jpg_0a316df698.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_amazon_ceo_andy_jassy_jpg_6c23224285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235337169_jpg_5585acdd15.webp)