Advertisement|Remove ads.

Apple Stock Slips As Jefferies Downplays AI iPhone Hype: Retail Investors Get Jittery

Shares of Apple Inc. ($AAPL) fell nearly 1% on Monday afternoon, as concerns mount over iPhone sales and the company’s AI strategy.

Jefferies assumed coverage of the stock with a ‘Hold’ and a price target of $212.92, up from a previous $205, signaling a more cautious outlook.

Analyst Edison Lee expressed skepticism about the near-term impact of Apple’s AI-powered iPhones, writing that “high expectations for iPhone 16/17 are premature.”

He emphasized that while Apple has long-term potential with its Apple Intelligence ecosystem, the lack of major new features and limited AI functionality in upcoming iPhones makes the projected 5%-10% unit growth unlikely.

Lee also noted that smartphone hardware will need significant upgrades to fully leverage AI, which he anticipates could take until 2026 or 2027.

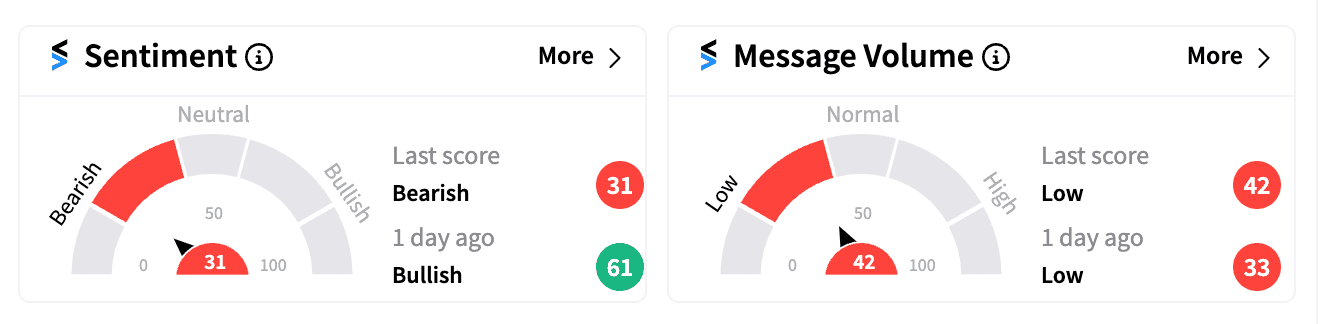

On Stocktwits, where Apple has the second-largest following of any stock with over 936,000 watchers, retail sentiment turned ‘bearish’ (34/100) from ‘bullish’ levels just a day earlier.

Apple shares are still up about 20% this year, but concerns over soft iPhone 16 demand and a delayed Apple Intelligence rollout have weighed on its stock performance.

Analysts are increasingly cautious, with Bloomberg reporting that only 65% of Wall Street analysts recommend buying Apple stock—well below the buy ratings seen for other tech giants like Microsoft, Nvidia, and Amazon, which boast buy ratios near or above 90%.

Adding to the uncertainty, Bloomberg also reported that Apple is moving away from its traditional annual product upgrade cycle, which could lead to more frequent releases but fewer major launches, a shift that may temper market excitement.

Read next: Scholar Rock Ignites Retail Buzz As Stock Rockets 300% On Positive Muscle-Targeted Therapy Trial

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2225607834_jpg_ea81c43992.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_toyota_logo_resized_dc32fc91b6.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/shanthi_v2_compressed_98c13b83cf.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/08/nvidia-2024-08-72b20e5921be505e7136db21db1e66f7.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2022/04/PayPal.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/TMC_resized_jpg_7e9bc7902f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Sourasis_Bose_Author_Image_939f0c5061.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/stock-market-2025-10-128c284bec3448e678cc68969f3ed130.jpg)