Advertisement|Remove ads.

Apple Reportedly Weighs Smart-Glasses Entry, But Stock Dips On Other Worrying News: What’s Retail Thinking?

Shares of Apple Inc. ($AAPL) slipped 0.4% pre-market Tuesday as news of potential expansion into smart glasses emerged amid weakening data from key supplier, Foxconn.

According to Bloomberg, Apple is exploring smart glasses with a market study under the codename “Atlas,” reportedly launched last week.

Apple employees are evaluating current offerings in the space, with additional focus groups planned, marking a possible challenge to smart-glasses makers like Meta ($META) and Snap Inc. ($SNAP).

Meanwhile, TF International Securities analyst Ming-Chi Kuo reported delays in Apple’s cheaper Vision Pro headset, now unlikely to debut before 2027.

Kuo attributes the delay to Apple’s struggle to create compelling use cases, similar to its experience with the HomePod series. The only anticipated headset release in 2025 is an upgraded Vision Pro with an M5 chip, Kuo noted on X.

Apple’s shares are also feeling pressure from Foxconn’s recent sales report, which showed the slowest monthly sales growth since February, reinforcing Apple’s cautious holiday-quarter outlook.

Loop Capital’s Ananda Baruah lowered the firm’s Apple price target from $300 to $275, trimming forecasts for iPhone sales, revenue, and average sales price (ASPs) for 2024-2026, suggesting weaker holiday demand.

Loop now anticipates 2024 iPhone revenue at $200.9 billion, down from $209.1 billion previously, with unit sales forecasted at 220.2 million vs. 224.3 million prior.

JPMorgan’s tracking tool indicated moderating delivery lead times across Apple’s iPhone 16 series, notably for Pro models, pointing to slightly weaker demand compared to iPhone 15. The firm remains ‘Overweight’ on Apple.

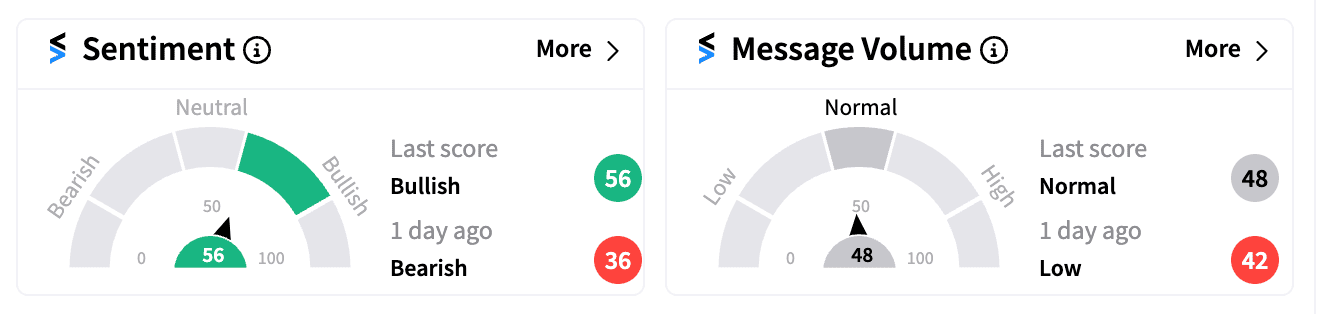

Retail sentiment on Stocktwits was ‘bullish’ going into Tuesday, despite bearish notes from analysts and concerns around Berkshire Hathaway ($BRK.A)($BRK.B) reducing its Apple holdings.

Some retail investors are also wary of possible market implications from today’s U.S. presidential election results.

Apple is up approximately 20% year-to-date.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)