Advertisement|Remove ads.

Apple Gets 2 Upbeat Analyst Notes: Stock Climbs But Retail Still Bearish Amid iPhone 16 Worries

Shares of Apple, Inc. (AAPL) rose 0.4% on Friday, on track for their second straight day of gains, following positive analyst commentary.

However, retail sentiment remains notably bearish, with many investors expressing doubts about Apple’s future performance.

In a new note, TF International Securities analyst Ming-Chi Kuo revealed that Apple’s upcoming M5-powered Vision Pro is expected to enter mass production in the second half of 2025.

The key highlight will be the integration of Apple Intelligence with spatial computing, along with a processor upgrade from the M2 to the M5, significantly boosting computing power, tha analyst said.

This is expected to enhance user experience, while keeping other hardware specs largely unchanged, which could help lower costs over time, according to Kuo.

In a separate note, Bank of America highlighted Apple’s opportunities in its Services strategy, with AI-related app downloads and a potential subscription platform for Apple Intelligence presenting major revenue opportunities.

The brokerage also sees Siri integration as an underappreciated area with massive potential. Bank of America maintains a ‘Buy’ rating on Apple with a $256 price target, forecasting Siri integration with apps could drive $3 billion in revenue by 2026 and up to $50 billion over the next decade.

Despite the upbeat projections, larger concerns linger over Apple’s iPhone 16 series.

According to New Street analyst Pierre Ferragu, initial sales for the iPhone 16 have been underwhelming, with “disappointing innovation” and a delayed rollout of Apple Intelligence. The firm has reduced its FY25 shipment forecast by 10%, pointing to market headwinds in China and elongating upgrade cycles.

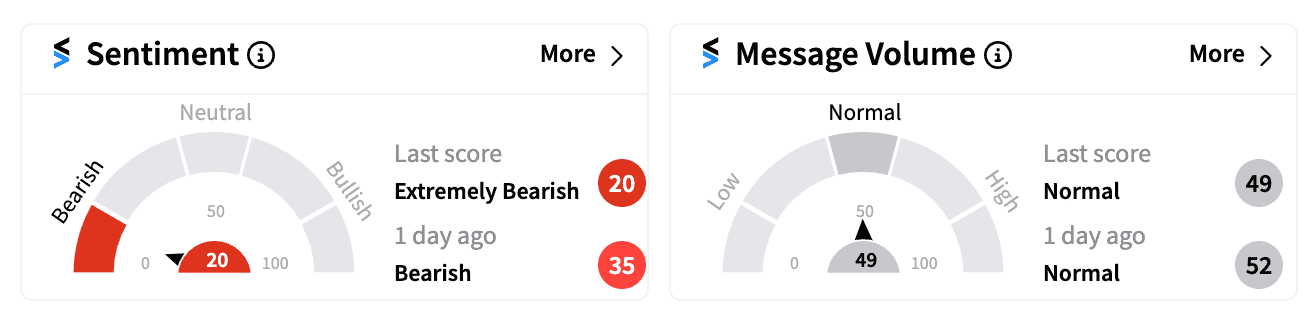

On Stocktwits, retail sentiment for Apple turned ‘extremely bearish’ (24/100) on Friday, with many users citing concerns over iPhone 16 demand and potential pullbacks.

However, AAPL remains up more than 22% year-to-date, and some analysts, like Ferragu, suggest that any near-term dip could present a buying opportunity, given the longer-term potential of Apple’s AI and services ecosystem.

Read next: Top US Gainer Onconetix Makes Retail ‘Extremely Bullish’ After VC Firm Boosts Stake

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2253201649_jpg_ff6c9e331b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232102203_jpg_175efe6ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2257784104_jpg_4f7b38e8a2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_jpg_f51342601b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)