Advertisement|Remove ads.

Apple Stock Dips As Analysts Point To Lackluster Early Demand For iPhone 16: Retail’s Faith Unshaken

Shares of Apple Inc (AAPL) fell over 3% on Monday morning after multiple analysts noted that early demand for the latest iPhones is lagging last year’s levels.

TF International Securities analyst Ming-Chi Kuo reportedly said that Apple is facing less demand for iPhone 16 Pro and iPhone 16 Pro Max than expected, though iPhone 16 and iPhone 16 Plus have had more sales compared to last year's iPhones.

The analyst noted that iPhone 16 series first-weekend pre-order sales are estimated at about 37 million units, down about 12.7% YoY from last year's iPhone 15 series first-weekend sales.

Chi-Kuo also added that one of the key factors for the lower-than-expected demand for the iPhone 16 Pro series is that the major selling point, Apple Intelligence, is not available at launch alongside the iPhone 16 release.

Meanwhile, Jefferies reportedly observed that although iPhone 16 Pro Max models sold out quickly in China, the delivery period of 2-3 weeks has not increased, implying a stable supply and a lack of surging demand. "The U.S. is much weaker than last year, unless Apple massively increased supply allocation," Jefferies reportedly said.

At the same time, Citi analysts noted that the delivery times for the iPhone 16 models are approximately a week shorter on average versus last year's iPhone 15 launch. "Compared with last year’s first day of pre-order of iPhone 15, the delivery time is on average a week shorter for iPhone 16," Citi reportedly stated.

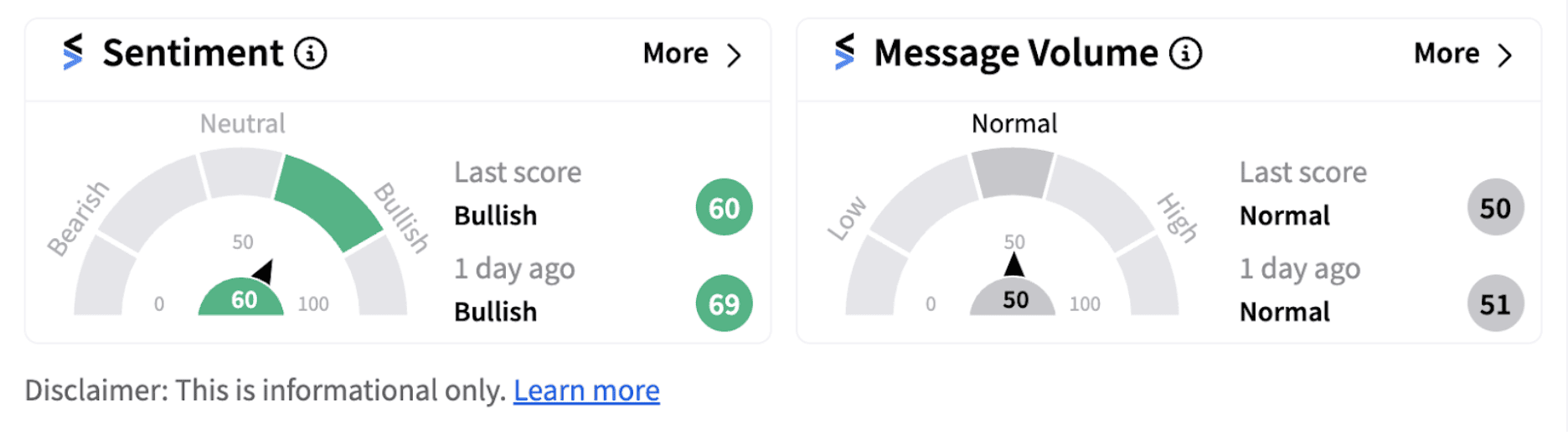

Despite the skepticism, retail sentiment on Stocktwits continued to remain in the ‘bullish’ territory (60/100), suggesting retail investors could be buying the dip.

One Stocktwits user believes the firm should take into consideration that the general public may not be as interested in AI as the companies tend to believe.

Another user has highlighted the need for innovation.

Apple shares have been trading above their 200-day moving average since May this year but are facing a stiff resistance in the $229-$236 range. On a year-to-date basis, the stock has returned nearly 20%.

Also See: Target Stock Closes Above 200-DMA On Friday: Retail Investors Alert As Sentiment Turns ‘Bullish’

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2253201649_jpg_ff6c9e331b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232102203_jpg_175efe6ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2257784104_jpg_4f7b38e8a2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_jpg_f51342601b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)