Advertisement|Remove ads.

Bullish Setup In Aarti Industries: SEBI RA Priyank Sharma Flags Swing Trade Opportunity

Aarti Industries has emerged as a stock to watch after rallying nearly 20% in the past month.

SEBI-registered analyst Priyank Sharma maintains a bullish stance, underpinned by technical indicators and price patterns.

Sharma points to a strong technical structure in the form of a 3-Drive Pattern breakout—an advanced bullish reversal pattern that typically signals the end of a downtrend.

Over the last seven months, Aarti Industries had been consolidating just below its 2023 low of ₹438, but recent price action has shifted decisively upward. This breakout, accompanied by rising momentum, suggests the beginning of a new swing phase for the stock.

Key levels to watch include the previous quarter high (PQH) at ₹477.75, which could trigger further gains.

The 2021 low of ₹465 has now become a crucial support level, and the stock is expected to hold above this threshold.

The 2023 low at ₹438 is being interpreted as a strong base formation, lending further credibility to the bullish thesis.

On the upside, the range between ₹550 and ₹560 is being seen as a potential resistance zone.

Based on this analysis, Sharma recommends a buy in the ₹460–₹415 range, with targets set at ₹550, ₹600, and ₹770. The suggested stop loss is at ₹390 on a weekly closing basis.

With the current market price around ₹490, this setup is positioned as a swing trade, with an expected duration of three weeks to four months.

While the technical picture appears promising, the company’s fundamentals present a mixed narrative.

In its recently announced March quarter results, Aarti Industries reported a 10% year-on-year growth in revenue, driven by gains in both its energy and non-energy businesses.

However, margin pressures continued to weigh on profitability, reflecting sector-wide cost headwinds.

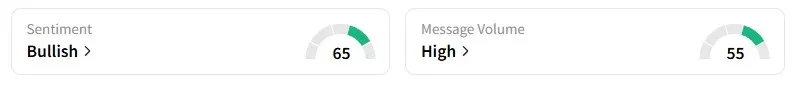

Brokerages remain divided in their outlook, but retail investor sentiment has turned noticeably optimistic. Stocktwits sentiment shifted to ‘bullish’ from ‘neutral’ over the last week.

Aarti Industries shares gained 18% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)