Advertisement|Remove ads.

Abbott Stock Slips On Disappointing Q3 Earnings Forecast: Retail Chatter Rises Over 200% In 24 Hours

Shares of Abbott (ABT) fell a steep 7% on Thursday morning after the company’s third-quarter earnings guidance disappointed investors.

For full-year 2025, Abbott expects adjusted diluted earnings per share of $5.10 to $5.20, in line with an analyst estimate of $5.16. The company, however, trimmed the higher end of its guidance from its previous estimate of $5.05 to $5.25.

In the second quarter (Q2), the company reported adjusted diluted earnings per share of $1.26, in line with analyst estimates, according to data from Fiscal AI. For the third quarter (Q3), the company expects adjusted diluted earnings per share of $1.28 to $1.32, below an expected $1.33.

Total sales came in at $11.14 million, marking a 7.4% jump on a reported basis, and above an analyst estimate of $11.06 billion, thanks to increased sales of its medical devices, including glucose monitors.

The company said its jump in sales from its nutrition, medical devices, and established pharmaceuticals segment helped offset a 1% drop in sales from its diagnostics segment in the period.

The medical devices segment brought in the largest chunk of sales, accounting for about 48% of the company’s overall sales.

Worldwide medical device sales increased 13.4%, led by double-digit growth in diabetes care and electrophysiology, among others, the company said. In diabetes care, sales of continuous glucose monitors were $1.9 billion and grew 21.4% on a reported basis.

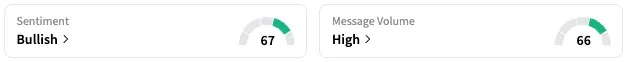

On Stocktwits, retail sentiment around Abbott rose from ‘neutral’ to ‘bullish’ territory over the past 24 hours while message volume remained at ‘high’ levels. Data shows message count on the platform jumped over 200% over the past 24 hours.

ABT stock is up by over 8% this year and by about 17% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2246431195_jpg_539619e6b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262983094_jpg_2896f12e4a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)