Advertisement|Remove ads.

AbbVie CEO Sees ‘Substantial Momentum’ For Remaining Year After Q2 Earnings Beat: Retail’s No Longer Pessimistic

AbbVie (ABBV) CEO Robert A. Michael on Thursday said that the drug maker is entering the second half of the year with “substantial momentum” after it reported second-quarter earnings that surpassed Street estimates and raised its full-year outlook.

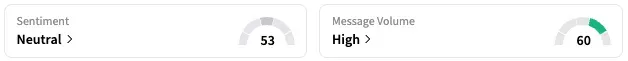

Shares of ABBV traded 5% higher in pre-market at the time of writing. On Stocktwits, retail sentiment around the stock improved from ‘bearish’ to ‘neutral’ territory, while message volume jumped from ‘normal’ to ‘high’ levels.

A Stocktwits user highlighted that it is the only pharma stock they have owned in 20 years.

For Q2, the company reported adjusted and diluted earnings per share of $2.97, up from $2.65 in the corresponding quarter of 2024, and above an analyst estimate of $2.88, according to Reuters data.

Net revenue for the three months through the end of June came in at $15.423 billion, marking an increase of 6.5% on an operational basis, and above an estimated $15.04 billion.

The rise in revenue was supported by an increase in sales of the company’s immunology and neuroscience portfolio of products. Immunology accounted for the lion’s share of the company’s revenue in the quarter after marking a 9.5% growth to $7.63 billion, aided by the company’s newer immunology drugs Skyrizi and Rinvoq.

Sales of the company’s rheumatoid arthritis drug Humira, however, slumped a steep 58% after it lost patent protection in the U.S.

"AbbVie delivered another outstanding quarter with strong performance from our diversified growth platform. We also made meaningful pipeline progress with several regulatory approvals, encouraging clinical data, and strategic investments in promising external innovation," the CEO said.

For the full year, the company raised its adjusted and diluted earnings per share guidance to $11.88 to $12.08, up from its previous guidance of $11.67 to $11.87.

The new guidance includes an unfavorable impact $0.55 per share related to acquired in-process research and development and milestone expense incurred this year, but not any that may be incurred after the second quarter.

ABBV stock is up by about 7% this year and by 2% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump2_jpg_ad63f384b5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_GE_Aerospace_resized_1_jpg_03f4fd7e4e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260447662_jpg_cd246b74f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)