Advertisement|Remove ads.

Adidas’ Apparel Surge Fuels Record Revenue Amid Tariff Turbulence

- Adidas’ Q3 revenue rises 12% and net profit rises 4.1%, according to preliminary results.

- The sportswear giant reaffirmed its full-year outlook and struck an upbeat tone for 2026.

- Management says the operating environment remains challenging.

Adidas posted record revenue and higher net profit in the last quarter, according to preliminary results released Wednesday — a standout performance at a time when U.S. tariffs have upended consumer trends and driven up costs for companies.

Growth Led By Apparel

The German sports goods giant said revenue rose 12% to 6.63 billion euros ($7.73 billion), and net profit jumped 4.1% to 461 million euros. Footwear sales grew 11%, apparel sales rose 16%, and accessories sales were up a mere 1%.

The company reiterated its forecast for the current year, which it had raised only last week. Adidas is targeting an operating profit of about 2 billion euros and a 9% year-over-year increase in full-year sales in 2025.

Challenging Environment

Sporting goods companies have faced a particularly tough few quarters, as the U.S. tariffs trade tariffs hit many Asian nations that serve as major manufacturing hubs for global apparel and footwear brands. Adidas rival Nike, meanwhile, is in the midst of a major turnaround, undertaking organizational restructuring and revamping its product strategy to reinvigorate its business.

Industry trends remain challenging, Adidas management said. “The environment is volatile with the tariff increases in the US and a lot of uncertainty among both retailers and consumers around the world,” CEO Bjorn Gulden said in a statement.

2026 Growth Opportunities

Gulden struck an optimistic tone for 2026, pointing to a packed sporting calendar — including the Winter Olympics and the Football World Cup — as key opportunities for growth. “We sell performance, comfort, and lifestyle. We see global demand for all these segments continue to grow.”

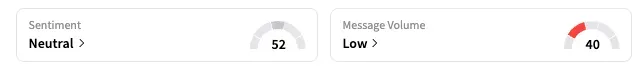

Adidas shares slid 1.2% lower on the Frankfurt Stock Exchange in the afternoon local time. On Stocktwits, the retail sentiment for the company’s over-the-counter shares in the U.S., ADDYY, was ‘neutral’ as of the last reading, unchanged from the previous day.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Stride Stock Plummets Premarket As Soft FY26 Outlook, Enrollment Tech Glitches Spook Investors

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)