Advertisement|Remove ads.

Why Did Plug Power Stock Plunge 21% After-Hours Today?

- The company had 1.39 billion outstanding shares as per its latest quarterly filing, and a market capitalization of over $2.9 billion.

- Alongside the primary offering, it also intends to grant purchasers an option to buy an additional $56.25 million in principal amount of notes, subject to certain conditions.

- Earlier this month, the firm took a strategic shift and suspended activities related to a $1.66 billion loan from the Department of Energy amid continued focus on data centers.

Plug Power (PLUG) stock fell over 21% in extended trading on Tuesday after the firm said it intends to offer $375 million worth of convertible bonds in a private offering.

The company had 1.39 billion outstanding shares as per its latest quarterly filing, and a market capitalization of over $2.9 billion. Plug Power also expects to grant the initial purchasers of the eight-year bonds an option to purchase up to an additional $56.25 million in principal amount of notes, subject to certain conditions.

Why Is Plug Power Offering The Notes?

Plug Power plans to use about $243 million of the net proceeds from the offering to fully repay the outstanding principal and interest on its 15.00% secured debentures and to pay the related termination fee. It also said that it would use the remaining funds to repurchase all or a portion of Plug Power’s existing 7.00% convertible senior notes due 2026 alongside other general corporate purposes.

Plug Power expects to tap into the booming demand for AI hyperscalers such as Amazon, Meta, and Alphabet’s Google, which are pouring billions into infrastructure. Earlier this month, the company signed a non-binding letter of intent to monetize its electricity rights in New York and at one other location, and to collaborate with a U.S. data center developer.

What Are Stocktwits Users Thinking?

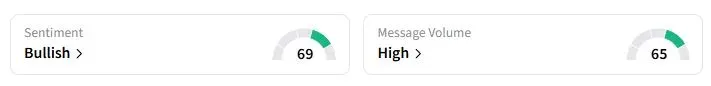

Retail sentiment on Stocktwits about Plug still moved to ‘bullish’ territory from ‘neutral’ a day ago.

“They’re using most of the money to eliminate high-interest debt and strengthen the balance sheet. There’s NO immediate dilution — these notes don’t convert until 2033,” one trader said.

Earlier this month, the firm took a strategic shift, suspending activities related to a $1.66 billion loan from the Department of Energy amid continued focus on data centers. It also said the move could lead to termination of the loan guarantee.

Plug Power stock has fallen marginally this year.

Also See: Why Did Eos Energy Stock Fall Over 3% After-Hours?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)