Advertisement|Remove ads.

Adobe Stock Draws Pessimistic Retail Reaction Ahead Of Wednesday’s Q1 Earnings

Visual illustration and editing software maker Adobe, Inc. (ADBE) is scheduled to release its quarterly results after the closing bell on Wednesday.

According to Finchat, analysts expect the San Jose, California-based company to report adjusted earnings per share (EPS) of $4.97 for the first quarter of the fiscal year 2025. This compares to the year-ago EPS of $4.48 and the guidance of $4.95-$5.00 issued mid-December.\

Revenue is estimated to grow over 9% year over year (YoY) to $5.66 billion, slower than the previous quarter’s 11% growth. The company’s guidance calls for $5.63 billion to $5.68 billion.

Investors may also focus on key operational metrics such as the remaining performance obligations (RPO), annualized recurring revenue (ARR) for digital media, document cloud, and creative businesses, and the net new digital media ARR.

Morgan Stanley analyst Keith Weiss said he sees a lower bar going into the earnings, as debates on Adobe's GenAI (generative artificial intelligence) positioning and increasing competition have led to the recent stock underperformance.

The analyst does not expect the first quarter results to resolve those debates materially.

Weiss’s channel checks revealed that the first quarter may have panned mainly in line with expectations, with Digital Media likely seeing growth in line with the trends in the fourth quarter. He noted that Digital Experience’s performance may have largely aligned with expectations.

The company’s fiscal year 2025 guidance currently stands at $20.20 to $20.50 in adjusted EPS and $23.30 billion to $23.55 billion in revenue.

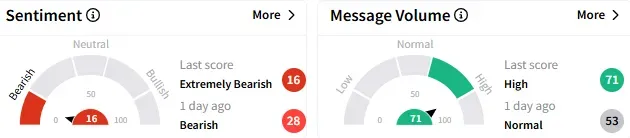

On Stocktwits, retail sentiment toward Adobe stock turned to ‘extremely bearish’ (16/100), worsening from the ‘bearish’ mood seen a day ago. The message volume perked to ‘high’ levels.

Given the market uncertainty, a bearish watcher expected a sell-off in the stock irrespective of how the quarterly report pans out. They also noted that Adobe’s earnings have usually triggered massive sell-offs.

Another user believes the stock is ‘overvalued.’

Adobe stock ended Tuesday’s session down 0.33% at $433.66. It has lost about 2.5% this year, not so worse than the nearly 10% decline in the tech-heavy Nasdaq Composite Index.

Morgan Stanley’s Weiss sees the upcoming Adobe Summit, scheduled for March 18-20, as the more likely positive catalyst, allowing the management team to dig into core investor debates.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Workday_logo_resized_d2d5258f05.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Lucid_jpg_221b9d07ec.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Draft_Kings_jpg_c77a08f48a.webp)