Advertisement|Remove ads.

Groupon Stock Jumps Premarket Despite Mixed Q4 Print As Investors Cheer Positive Outlook: Retail Smells A Bargain Buy

Groupon, Inc. (GRPN) shares rallied strongly in Wednesday’s premarket trading as investors cheered the e-commerce company’s positive guidance despite a mixed quarterly performance.

The Chicago-based company reported a loss of $1.20 per share for the fourth quarter of the fiscal year 2024, wider than the loss of $0.04 estimated by analysts, according to Stocktwits.

Groupon reported a profit of $0.76 a year ago.

The adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) was $18.7 million versus $26.9 million in the year-ago quarter.

Revenue fell 5% year over year (YoY) to $130.4 million and yet beat the consensus estimate of $127.7 million.

Groupon said gross billings slipped 1% to $430.1 million, and unit sales declined 8% to 10.3 million. Active customers were down 6% at 15.4 million as of Dec. 31.

The company ended the quarter with a cash position of $228.8 million and generated a free cash flow of $63.2 million.

Dusan Senkypl, Chief Executive Officer of Groupon, said, “In 2024, we successfully executed our transformation strategy, returning North America Local to growth and generating positive free cash flow for the first time since exiting the pandemic.”

Looking ahead, Groupon guided revenue of $114 million to $117 million for the first quarter and $493 million to $500 million for the fiscal year 2025. This compares to the consensus of $115.7 million and $488.9 million, respectively.

The company expects an adjusted EBITDA of $7 million to $10 million for the first quarter and $70 million to $75 million for the year.

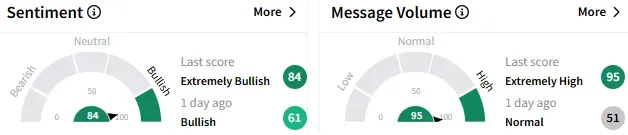

On Stocktwits, retail sentiment toward Groupon stock turned to ‘extremely bullish’ (84/100) from the ‘bullish’ mood that prevailed a day ago. With the earnings release, retail chatter grew louder to ‘extremely high’ levels.

A bullish user said the new board is getting the company back on track, adding that the stock could be a bargain buy.

Another user braced for stock gains with a potential recession looming large.

In premarket trading, Groupon stock climbed 21.80% to $11.90. The shares have fallen about 20% this year.

If the premarket gains carry over to the regular session, the stock could be on track to record its biggest single-day gain since May 2024, according to Koyfin.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)