Advertisement|Remove ads.

BNPL Player Affirm Holding’s Stock Rises After-Hours On Analyst’s Bullish Initiation But Retail Stays Cautious

Buy-now, pay-later (BNPL) platform provider Affirm Holdings, Inc. (AFRM) stock added an incremental 2.74% in Monday’s after-hours session following a 5%+ rally in the regular session.

The gains in the extended trading hours came after the San Francisco, California-based company received a bullish recommendation from a Wall Street firm.

TheFly reported that TD Cowen Securities initiated coverage of Affirm Holdings stock with a ‘Buy’ rating and a $50 price target, implying 33% upside from current levels.

Analysts at the firm named Affirm as one of the top performing buy-now-pay-later brands in the U.S. with a full-suite point-of-sale lending capability versus peers. They added that the company likely has the most pro-consumer practices in the industry.

Also, Affirm Holdings has more seasoned underwriting capabilities versus peers, given that it started out underwriting longer-term loans first before adding pay-in-four capabilities, Cowen said.

The firm was also positive about Affirm's slate of "heavyweight partners" in e-commerce, including Amazon, Inc. (AMZN) and Shopify, Inc. (SHOP).

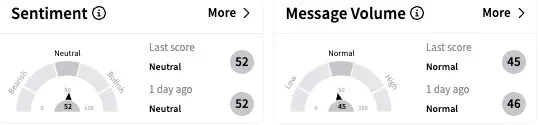

On Stocktwits, retail sentiment toward Affirm stock remained ‘neutral’ (52/100) and the message volume stayed ‘normal.’

A bullish watcher said they bought the dip at the $34 level and will add more if the stock falls further.

On the other hand, a bearish user said the stock could be headed toward the $25-$30 range.

Affirm Holdings stock traded at $47.75 ahead of the Trump tariff sell-off and it is currently down over 38% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: How Much Will Made-In-China iPhones Cost After Trump Tariffs? UBS Estimates Lower Hit Than Feared

/filters:format(webp)https://news.stocktwits-cdn.com/large_M_and_A_deals_acquisitions_resized_jpg_a56d5b5e28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_semtech_logo_resized_jpg_f9b0e1e71e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ross_stores_resized_jpg_e7e996e005.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2252956558_jpg_2dc0e5e537.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Git_Lab_resized_49b70b74d0.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_moderna_covid_jpg_3eb7363e71.webp)