Advertisement|Remove ads.

How Much Will Made-In-China iPhones Cost After Trump Tariffs? UBS Estimates Lower Hit Than Feared

Apple, Inc. (AAPL) shares bucked the tech rebound on Monday and settled lower for a third session in a row, underlining investor concerns about the impact of the reciprocal tariffs on the company’s fundamentals.

Analysts at UBS said in a late Monday report that the tech giant may be forced to raise prices of its key hardware products to absorb the tariff costs, Apple insider reported.

However, the firm’s price-hike estimates have been lower than what some sell-side firms had expected earlier.

UBS expects the price of the top-tier iPhone 16 Pro Max 1 TB storage capacity to rise to $2,062 versus the $2,300 estimated by Rosenblatt Securities last week. Apple bull and Wedbush analyst Daniel Ives said an iPhone could cost as much as $3,500 if manufacturing is shifted out of China into the U.S.

The Swiss-based brokerage sees China-assembled iPhone prices to go up by 29%, considering the 54% tariff rate in effect currently, while those assembled in India may see a 12% price raise.

According to the firm’s estimates, the iPhone 16 Pro with 128 GB storage capacity will likely cost $1,119 from the current $999.

UBS expects Vietnam assembled Apple Watch Ultra 2 to see a 19% price hike.

The tariffs applicable to India and Vietnam are 26% and 46%, respectively.

UBS said, "“Based on the checks we have done at a company level, there is a lot of uncertainty about how the increased cost sharing will be done with suppliers, the extent to which costs can be passed on to end-customers, and the duration of tariffs,”

The firm also recommended investors not to throw in the towel yet by pointing out that after the 2018 tariffs, things stabilized for the stock after the uncertainty was priced in. However, the firm cautioned that this time around the tariffs are sweeping and are of higher magnitude than then.

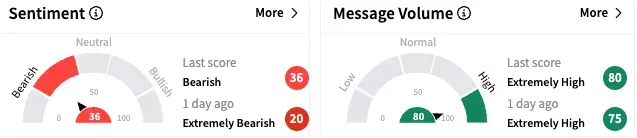

On Stocktwits, retail sentiment toward Apple stock was ‘bearish’ by late Monday, although it marked a slight improvement from the ‘extremely bearish’ mood that prevailed a day ago. The message volume on the Apple stream stayed ‘extremely high.’

A bearish watcher on the platform based his pessimism on President Donald Trump’s warnings of additional 50% tariffs on China if the country does not withdraw the retaliatory tariff it has imposed on the U.S.

Another user said a “death cross” — a bearish technical formation, is imminent for Apple.

On Monday, Apple stock fell 3.67% to $181.46, taking losses over three sessions to 19%. The stock has lost about 28% since the start of the year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)