Advertisement|Remove ads.

Alaska Air Completes Acquisition Of Hawaiian Holdings After Securing DoT Agreement: Retail Cheers The Deal

Alaska Air Group, Inc. (ALK) said on Wednesday it has completed the acquisition of Hawaiian Holdings, Inc. (HA) after securing an agreement with the Department of Transportation (DoT). Shares of Alaska Air were down nearly 2%.

The DoT had said Tuesday that Alaska and Hawaiian are required to protect the value of rewards, maintain existing service on key Hawaiian routes to the continental United States and inter-island, and preserve support for rural service.

Other terms included ensuring competitive access at the Honolulu hub airport, guarantee fee-free family seating and alternative compensation for controllable disruptions, and lower costs for military families.

The deal comes as a big relief to both the firms given the fact that proposed airline mergers have faced tough opposition from the Biden administration.

Both the airlines will now begin the work to secure a single operating certificate with the Federal Aviation Administration (FAA), which will allow them to operate as a single carrier with an integrated passenger service system.

According to the DoT, this is the first time it is requiring airlines to agree to binding, enforceable public-interest protections in order to permit the airlines to close their merger.

In the interim, the firms will continue to operate as separate carriers with no immediate changes to operations and will maintain separate websites, reservation systems and loyalty programs until later in the integration process, Alaska Air said. The company also stated that it will preserve and grow union-represented jobs in Hawai’i.

The companies expect run-rate synergies of unto $235 million and high single-digit accretion to earnings within the first two years and mid-teens return on invested capital (ROIC) by year three.

With the conclusion of the acquisition, Hawaiian Airlines' stock will be delisted and cease trading on the NASDAQ on Sept. 18. The combined organization will continue to trade under the ticker ALK on the New York Stock Exchange.

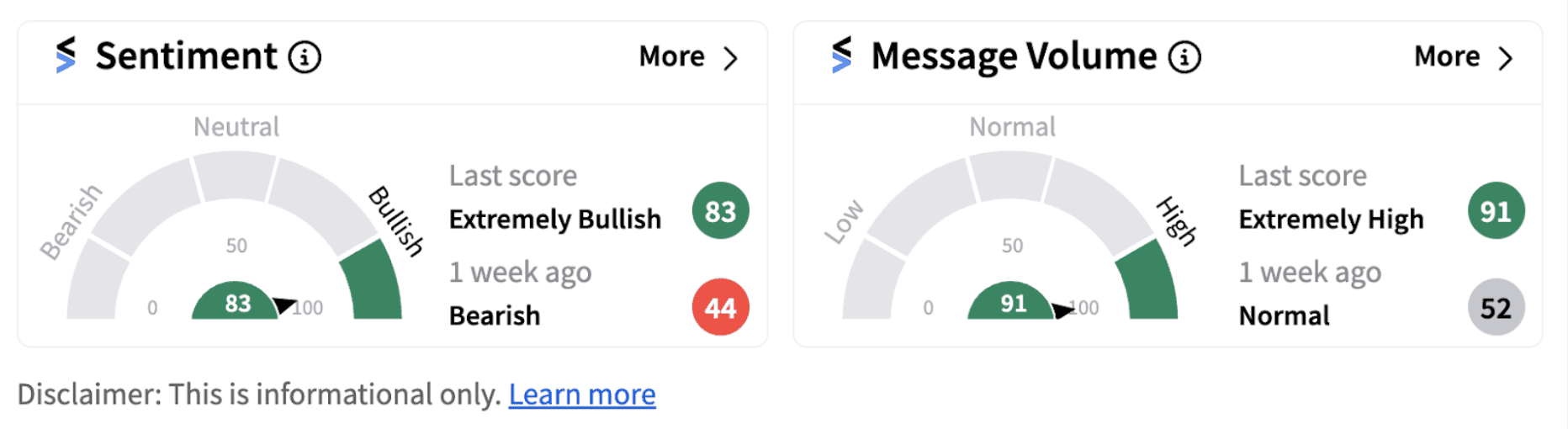

Following the announcement, retail sentiment for Alaska Air stock was trending in the ‘bullish’ territory (83/100).

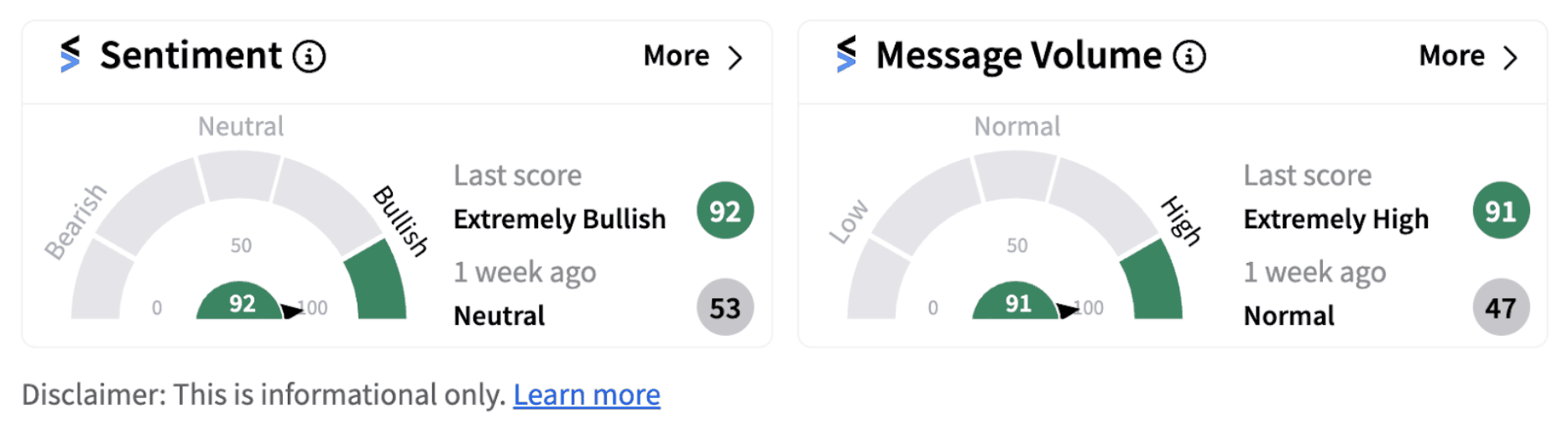

For Hawaiian Holdings, the sentiment meter flipped into the ‘extremely bullish’ territory (92/100).

With the conclusion of the acquisition, Honolulu will become Alaska Air's second largest hub and a regional headquarters with a strong operations presence and the continuation of pilot, flight attendant and maintenance technician bases.

Also See: General Mills Reports Mixed Q1 But Retail’s Bullish: Stock Inches Up Toward One-Year Highs

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jamie_Dimon_July_736ff90d31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218181377_jpg_f2dccc3db9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2245017747_jpg_f783731632.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_China_i_Phone_jpg_bcedab655a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_American_Airlines_Getty_4d3d704837.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)