Advertisement|Remove ads.

General Mills Reports Mixed Q1 But Retail’s Bullish: Stock Inches Up Toward One-Year Highs

General Mills (GIS), on Wednesday, reported a 1% year-over-year (YoY) decline in its first-quarter net sales to $4.80 billion, which came in line with Wall Street estimates. Shares of the firm were trading over 1% higher.

The drop in net sales was driven by unfavorable net price realization and mix. The company’s organic net sales were also down 1%, led by unfavorable organic net price realization and mix.

The Cheerios-maker reported a 2% YoY drop in its adjusted diluted earnings per share (EPS) at $1.07 versus an estimate of $1.06. Operating profit declined 11% to $832 million, due to lower gross profit dollars and higher selling, general, and administrative (SG&A) expenses, including increased media investment.

CEO Jeff Harmening said the firm’s top priority in fiscal 2025 is to accelerate its organic net sales growth. “…and we made expected progress on that goal in the first quarter along multiple fronts, with more work still ahead,” he stated.

General Mills’ North America Retail segment sales were down 2% to $3 billion, driven by lower pound volume. This was partially offset by favorable net price realization and mix. Meanwhile, net sales were down mid-single digits for the U.S. Snacks operating unit and down low-single digits for U.S. Morning Foods.

Going forward, the company believes volume trends in its categories will gradually improve in fiscal 2025, though full-year category dollar growth is expected to remain below its long-term growth projections.

For fiscal 2025, organic net sales are expected to range between flat and up 1% while adjusted operating profit is expected to range between down 2% and flat in constant currency.

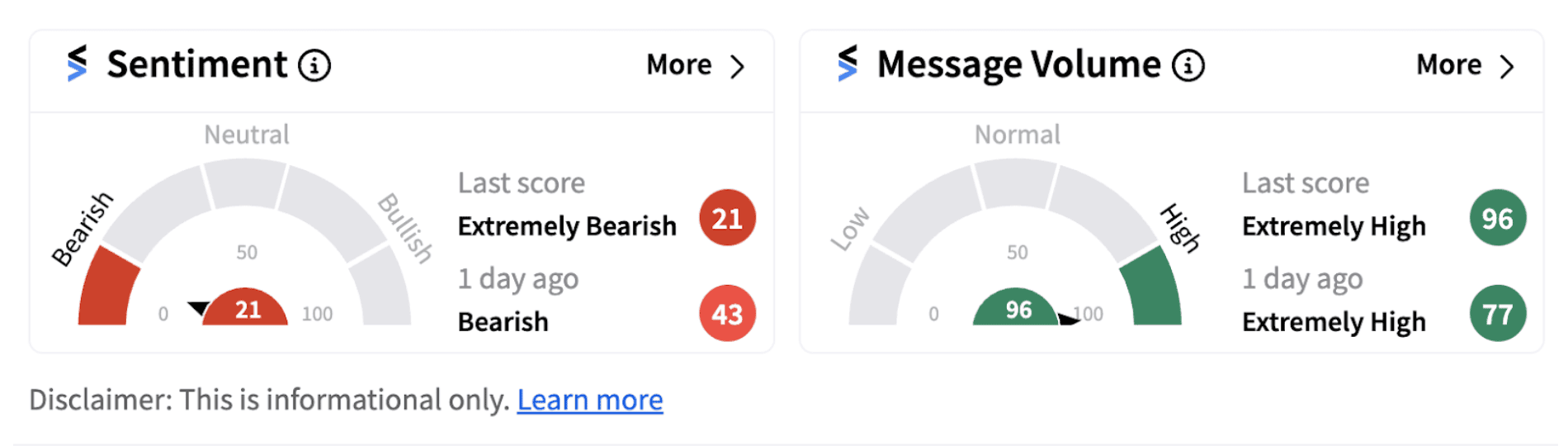

Following the earnings report, retail sentiment on Stocktwits dipped into the ‘extremely bearish’ territory (21/100) accompanied by ‘extremely high’ message volumes that hit a one-year high.

Recently, General Mills announced its plan to sell its North American Yogurt business to leading French dairy companies Lactalis and Sodiaal, in cash transactions valued at an aggregate $2.1 billion.

Lactalis will acquire the U.S. business while Sodiaal will acquire the Canadian business. The transactions are expected to close in calendar year 2025, it said.

General Mills shares have gained nearly 13% since the beginning of the year. If Wednesday morning’s positive momentum remains intact, the stock is likely to hit over one-year highs.

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263849665_jpg_4d6eff48f1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_janetyellen_resized_jpg_ea2c28f284.webp)