Advertisement|Remove ads.

Albertsons Tops Q1 Results On Strong Digital, Pharmacy Sales: Retail Turns Bullish

Albertsons Companies' (ACI) first-quarter profit and sales beat Wall Street expectations on Tuesday, driven by strong pharmacy demand and more customers buying groceries and other essentials through its digital channel.

Albertsons' shares were up marginally during premarket trading on Tuesday.

The company’s first-quarter (Q1) sales rose 2.5% to $24.88 billion, compared to analysts’ estimates of $24.69 billion, according to data from FinChat. Adjusted earnings per share (EPS) came in at $0.55 per share, compared to the estimated $0.54.

Analysts have said the company has seen a pullback in demand for non-essential items as customers became more cautious, in the aftermath of U.S. tariffs that have led to price hikes on everyday products, including household and personal care items.

The company said it has been investing in loyalty programs, digital platforms, and pharmacy services, which have boosted engagement. It is rolling out a $1.5 billion productivity initiative through 2027 to improve efficiency and reinvest in growth following its failed merger with Kroger (KR).

Albertsons raised its annual identical sales forecast to 2.0% to 2.75%, from the previous expectation of 1.5% to 2.5%. It kept its adjusted profit forecast of $2.03 to $2.16 per share unchanged.

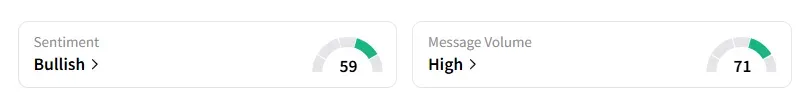

Retail sentiment on the stock improved to ‘bullish’ from ‘bearish’ territory a day ago, with chatter at ‘high’ levels, according to data from Stocktwits.

Albertsons’ stock has gained nearly 13% year-to-date, while it's up 12% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Jefferies Downgrades DoorDash To ‘Hold,’ Retail Remains Skeptical

Editor's Note: An earlier version of the story incorrectly mentioned the period as the second quarter instead of the first.

/filters:format(webp)https://news.stocktwits-cdn.com/large_lucid_stock_jpg_167f2bc3dd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_So_Fi_new_6d7889a863.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ibm_signage_resized_1a6adb0393.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740483_jpg_28cc9c7ce9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)