Advertisement|Remove ads.

Alibaba Group Stock Soars On Q3 Earnings Beat, Cloud Computing Gains: Retail Stays Bullish

U.S.-listed shares of Alibaba Group Holding (BABA) rose more than 8% on Thursday and were climbing in after-hours trading after the Chinese e-commerce giant posted quarterly results, with retail sentiment staying bullish.

Alibaba’s fiscal third-quarter (Q3) earnings per share came in at $2.95, beating Wall Street estimates of $2.66. Revenue came in at $38.61 billion, up 8% year-over-year, compared to consensus estimates of $38.1 billion.

The company saw “substantial progress” in its AI strategies and “re-accelerated growth” of its core businesses. Customer management revenue at Taobao and Tmall Group grew 9%, driven by initiatives to enhance user experience and effective monetization.

Alibaba’s Cloud revenue grew by 13% in the December quarter, with AI-related product revenue achieving triple-digit growth for the sixth consecutive quarter, said Eddie Wu, CEO of Alibaba Group. The company expects its revenue growth to accelerate at its cloud intelligence group, driven by AI.

“We will continue to execute against our strategic priorities in e-commerce and cloud computing, including further investment to drive long-term growth,” said Wu.

Toby Xu, CFO of Alibaba Group, said, “While we made substantial investments to spark growth re-acceleration in our core businesses, we maintained financial discipline with enhanced operational efficiency, achieving positive EBITA growth in Taobao and Tmall Group. During the quarter, we continued to actively manage our balance sheet with significant non-core asset sales, share buybacks, and extending our debt maturities at attractive rates.”

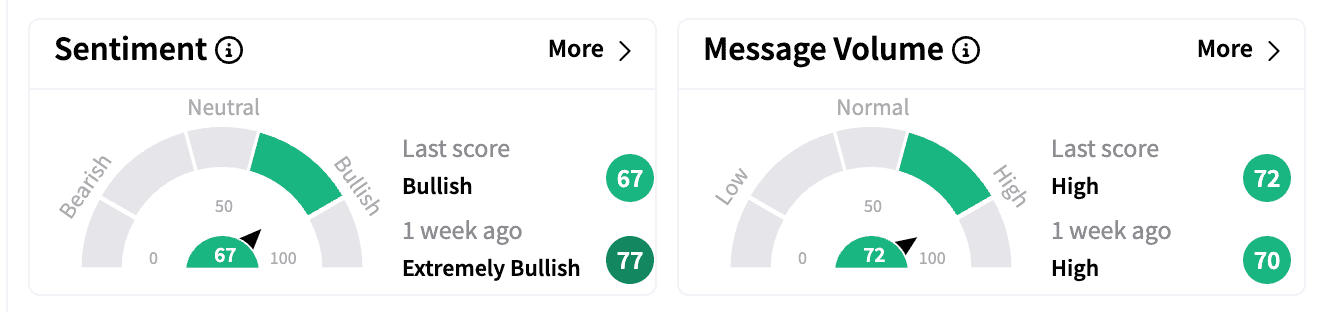

Sentiment on Stocktwits was ‘bullish’ compared to ‘extremely bullish’ a week ago. Message volume remained in the ‘high’ zone.

Jefferies analyst Thomas Chong raised the firm's price target to $160 from $156 with a ‘Buy’ rating based on its December quarterly results that exceeded expectations on customer management revenue, cloud and Taobao and Tmall Group EBITA, Fly reported.

According to the firm, Alibaba’s results were "impressive" and noted the company’s "competitive moat" integrating cloud and artificial intelligence models.

Alibaba, in its statement, said it remains committed to advancing its multi-modal AI technology and expanding its open-source initiatives. In January, it open-sourced its AI model Qwen2.5-VL, launching its flagship MoE-based model Qwen2.5-Max, a rival to DeepSeek.

Alibaba ADR shares are up 60.3% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)