Advertisement|Remove ads.

US Election 2024: Alibaba, JD, Baidu Stocks Slip As Trump Mulls China Hawks For Cabinet, But Retail Stays Upbeat

U.S.-listed stocks of major Chinese technology companies tumbled on Tuesday after reports that President-elect Donald Trump is considering politicians who hold hardline positions on China for key roles within his cabinet.

The prospect of painful U.S. tariffs has overpowered the usual bullishness seen at the end of Singles Day — China’s version of Black Friday.

Trump has reportedly asked U.S. representative Micahel Waltz to be his national security adviser and Florida senator Marco Rubio for secretary of state.

Waltz, a retired Army officer and China taskforce member, has been vocal about taking a tough stance on China, including calling for a U.S. boycott of the 2022 Beijing Olympics over issues like the pandemic cover-up.

Rubio, a leading critic of China in the Senate, has pushed for action against Chinese tech firms, including urging a review of TikTok’s acquisition of Musical.ly and pushing for sanctions on Huawei.

During the campaign, Trump pledged to impose tariffs of up to 60% on Chinese imports, a move that could affect $500 billion in goods, further contributing to market concerns.

Here’s a list of the Chinese stocks that are feeling the brunt:

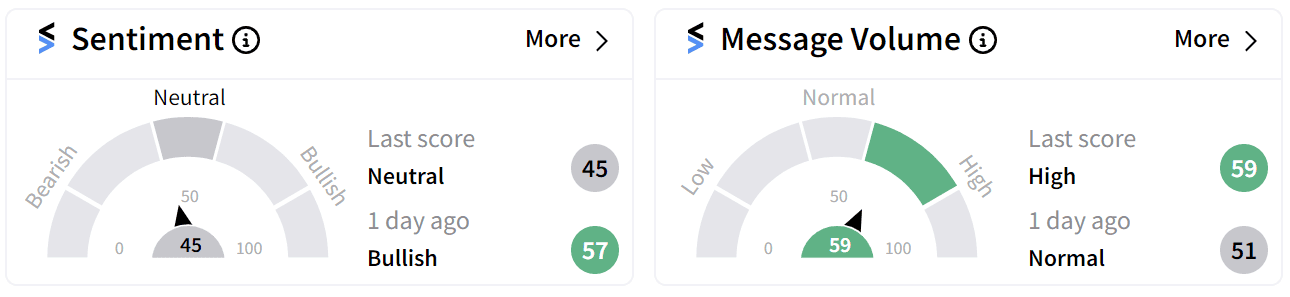

Alibaba Group Holding Limited ($BABA)

Alibaba’s stock dropped by 3% in early trading on Tuesday. Retail sentiment around the stock dipped to ‘neutral’ (45/100) from ‘bullish’ amid an uptick in chatter to ‘high’ (59/100).

Users on Stocktwits are divided on whether Alibaba will thrive or dive once Trump takes office in January.

Alibaba’s shares have lost 7.3% of their value since Trump won the 2024 U.S. election last week but are still holding onto gains of 23% this year so far.

The Chinese e-commerce giant is scheduled to report its second-quarter earnings on Friday with Wall Street expecting earnings of $2.05 per share on revenue of $33.21 billion.

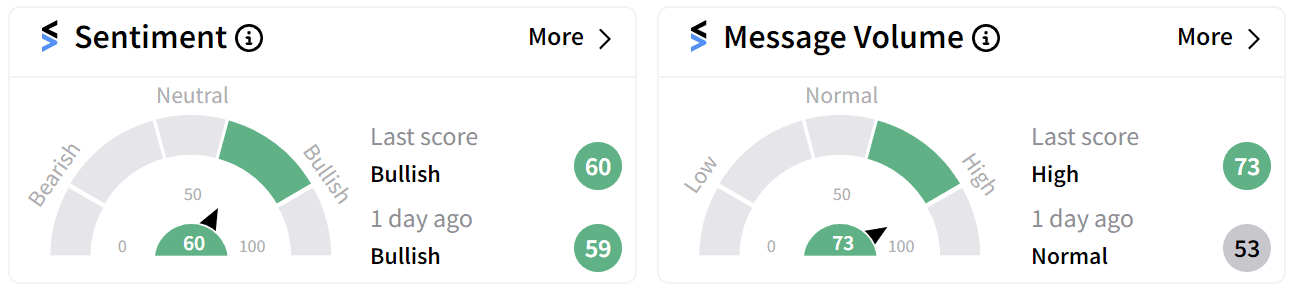

JD.com Inc. ($JD)

Shares of JD.com dropped over 6% on Tuesday but retail sentiment around the stock remains ‘bullish’ (60/100), bolstered by an uptick in chatter to ‘high’ (73/100).

Shares of JD.com have dipped nearly 9% since Trump won the 2024 U.S. election last week but are still holding onto gains of 34% so far in 2024.

The company will be reporting its third-quarter earnings on Thursday with Wall Street expecting earnings of $1.06 per share on revenue of $36.46 billion.

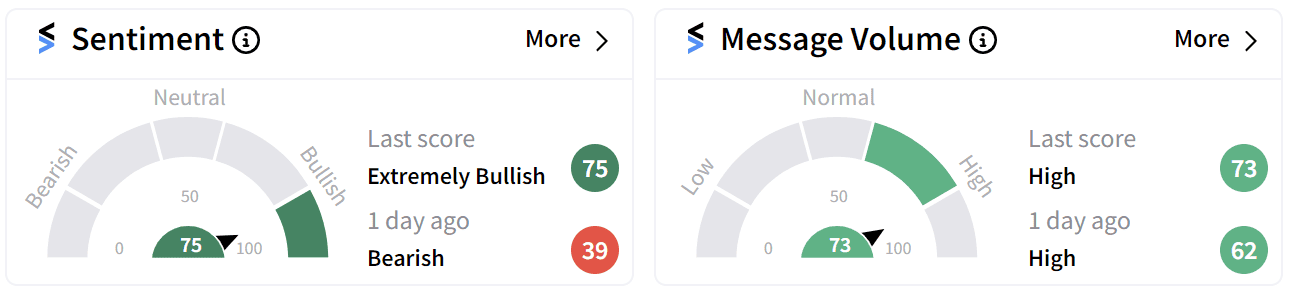

Baidu Inc. ($BIDU)

Baidu’s stock fell nearly 4% on Tuesday morning but retail sentiment moved in the opposite direction, flipped to ‘extremely bullish’ (75/100) from bearish a day ago.

Mizuho also lowered its price target on the stock from $130 to $115 while maintaining an ‘Outperform’ rating.

Users of Stocktwits are bullish on Baidu’s future outlook despite the threat of tariffs under the Trump administration.

Baidu’s stock has dropped 7.6% since Trump’s victory in the 2024 U.S. election last week, extending its decline to a total of 26% so far this year.

The company will be reporting its third-quarter earnings next with Wall Street expecting earnings of $2.49 per share on revenue of $4.68 billion.

For updates and corrections email newsroom@stocktwits.com.

Read more: Camtek Shares Jump Premarket As HPC Demand Drives Earnings Beat: Retail's Overjoyed

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260447662_jpg_cd246b74f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2254924116_jpg_d54ffea07e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228900989_jpg_e94daec744.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)