Advertisement|Remove ads.

Allstate Gains Premarket After Q4 Profit Beat: Retail’s Bullish But Concerns Linger Over California Wildfires

Allstate Corp (ALL) shares rose 2.1% in premarket trade on Thursday after the company’s fourth-quarter earnings topped Wall Street estimates.

According to Koyfin data, the insurer reported an adjusted net income of $7.67 per share, higher than an estimate of $6.28 per share.

The company’s revenue rose 11.2% to $16.51 billion compared to last year. Analysts, on average, expected revenue of $16.23 billion.

Allstate’s property liability premiums rose 10.6% to $13.93 billion compared to the year-ago quarter, primarily driven by higher average premiums.

The company’s underlying combined ratio fell to 83% from 86.9% last year. A below 100% ratio implies the company earned more premiums than it shelled out less in insurance claims.

Allstate’s auto insurance unit premiums rose 9.1% to $9.35 billion, aided by rate increases partially offset by a decline in policies in force.

Its net investment income rose to $833 million from $604 million in the year-ago quarter, driven by repositioning into higher-yielding fixed-income securities.

The firm’s catastrophe losses soared to $315 million due to the hurricanes Milton and Helene.

Allstate expects California wildfires and related losses to be about $1.1 billion.

Last week, peer Chubb said it expects a $1.5 billion hit during the first quarter due to the January wildfires, which multiple agencies described as the costliest in U.S. history.

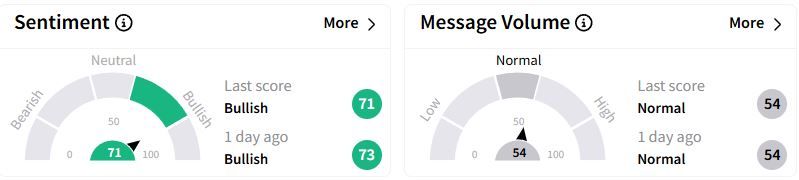

Retail sentiment on Stocktwits moved slightly lower in the ‘bullish’ (71/100) territory than a day ago, while retail chatter was ‘normal.’

However, some users expressed concerns about whether the wildfire losses would be revised later.

The company had agreed to sell its Group Health business to Nationwide for $1.25 billion in January.

Over the past year, Allstate stock has gained 23.4%.

Also See: Patterson-UTI Stock Trades In Red Pre-Market After Q4 Revenue Miss: Retail Stays Bearish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUNR_Intuitive_Machines_resized_jpg_5655032711.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)