Advertisement|Remove ads.

Ally Financial Shares Fall Premarket After Q3 Earnings Report: Retail Ignores Market Pessimism

Shares of Delaware-based Ally Financial Inc ($ALLY) on Friday fell over 3% in pre-market trading after the company reported its third-quarter earnings.

Ally Financial reported adjusted earnings per share (EPS) of $0.95, higher than a Wall Street estimate of $0.51. Revenue rose 1% year-over-year (YoY) $2.1 billion versus an estimate of $2.04 billion.

The company said its net financing revenue stood at $1.5 billion, down $45 million YoY, primarily driven by lower average earning assets and higher funding costs. Net interest margin (NIM) of 3.22% decreased 2 basis points (bps) YoY.

Meanwhile, provision for credit losses increased $137 million YoY to $645 million, reflecting higher net charge-offs and a 15 bps rise in the retail auto reserve rate in the third quarter.

From a segmental point of view, auto finance witnessed net financing revenue of $1.285 billion decline by $75 million YoY, driven by elevated funding costs.

Corporate Finance saw net financing revenue of $101 million, up $4 million YoY, primarily driven by higher income spreads and fees from loan payoffs. Meanwhile, Mortgage Finance saw its net financing revenue come in at $52 million, down $1 million YoY.

Ally said it paid a $0.30 per share quarterly common dividend during the quarter. The firm’s board of directors approved a $0.30 per share common dividend for the fourth quarter of 2024.

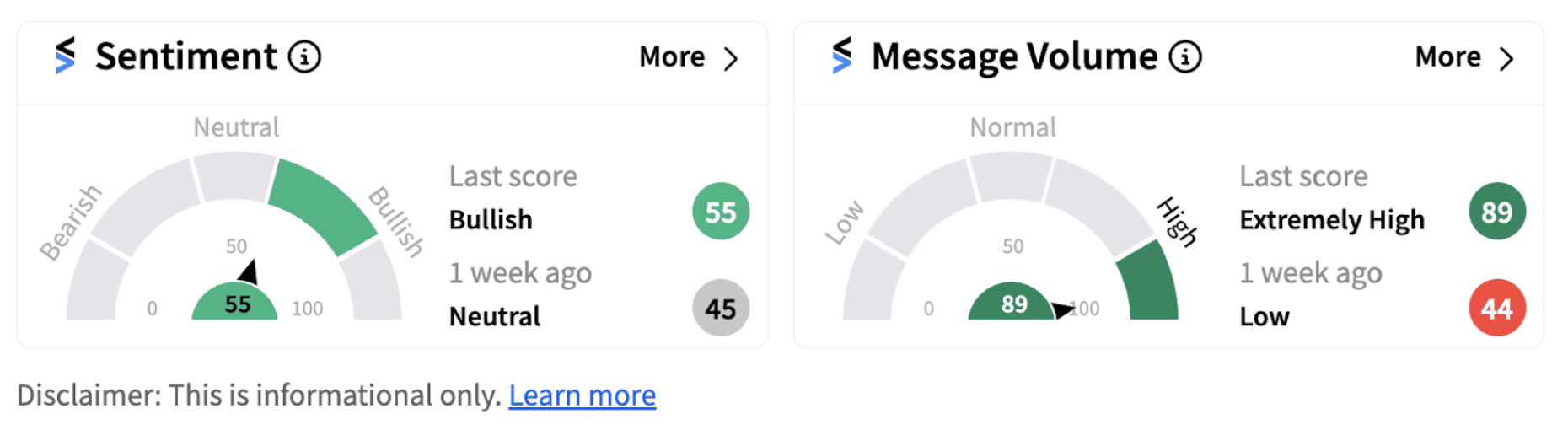

Following the earnings release, retail sentiment on Stocktwits was trending in the ‘bullish’ territory (55/100), compared to ‘neutral’ a week ago.

Stocktwits users with a bullish outlook on the firm are expressing optimism on the stock’s prospects. One user believes shares of the company should hit the $40 mark.

Another user praised the earnings report.

Shares of Ally Financial, however, have gained just over 1% this year so far.

Also Read: Nvidia Stock Eyes New Highs After BofA Price Target Boost: Retail Sentiment Glows

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)