Advertisement|Remove ads.

Nvidia Stock Eyes New Highs After BofA Price Target Boost: Retail Sentiment Glows

Nvidia Corp ($NVDA) shares were trading over 1% higher in Friday’s pre-market session after Bank of America Securities (BofA) upgraded the price target on the stock.

BofA reportedly raised its target on Nvidia stock to $190 from $165, while keeping a ‘Buy’ rating on the shares, implying more than a 38% upside from current trading levels.

The brokerage reportedly raised its calendar year 2025 and 2026 pro-forma earnings per share (EPS) estimates for Nvidia by 13% and 20%, respectively.

BofA analyst Vivek Arya reportedly noted that recent industry events such as Taiwan Semiconductor’s ($TSM) third-quarter earnings and Nvidia CEO Jensen Huang’s statement that demand for its Blackwell chip is “insane” could boost the firm’s competitive lead and generational opportunity.

“We also highlight a growing presence of AI in enterprise, where NVDA is the partner of choice,” the analyst reportedly stated in a note to clients. “NVDA’s engagements span multiple verticals (e.g., Accenture, ServiceNow, Microsoft), and offerings such as AI Foundry, AI Hubs, NIMs are key levers to its AI leadership, not only on the hardware side but also on systems/ecosystems side.”

The BofA analyst also noted that Nvidia could see a minimum of $200 billion in free cash flow generation over the next two years, giving it a growth optionality.

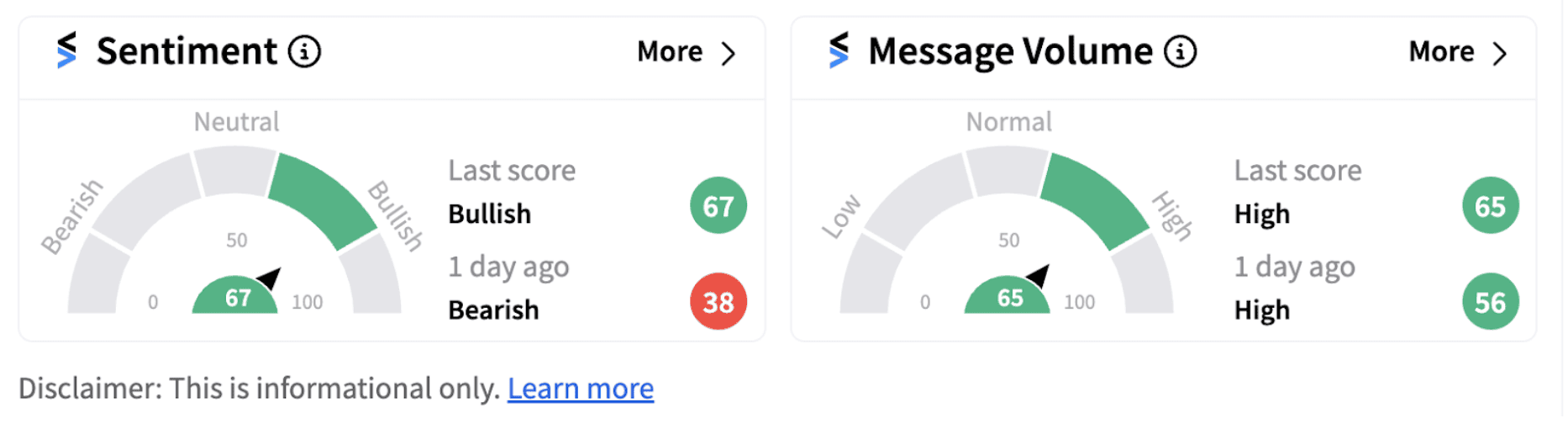

Following the announcement, retail sentiment on Stocktwits flipped into the ‘bullish’ territory (67/100) from ‘bearish’ a day ago.

Nvidia and other chip company stocks recorded gains recently after TSM came out with an upbeat commentary about the AI market.

Nvidia shares hit record high on Thursday and are on track to hit new highs on Friday as well. On a year-to-date basis, the stock has returned over 184%, significantly outperforming the benchmark U.S. indices.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)