Advertisement|Remove ads.

Alphabet, Manhattan Associates, AT&T Draw Heavy Retail Chatter On Stocktwits Among Tech Stocks: More Details Inside

The tech-heavy Nasdaq Composite Index closed 0.61% higher at 21,020 on Wednesday, with earnings providing a boost. Here are the top three tech companies that saw the highest retail chatter on Stocktwits in the last 24 hours.

1. Alphabet Inc. (GOOGL) (GOOG): The technology giant saw retail chatter surge 506% in 24 hours after the company reported better-than-expected second-quarter (Q2) earnings.

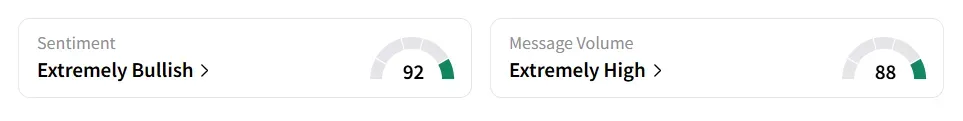

Retail sentiment around the stock improved to ‘extremely bullish’ (92/100) from ‘bullish’ territory the previous day. Message volume jumped as well, to ‘extremely high’ (88/100) from ‘high’ levels in the last 24 hours.

Alphabet stock traded over 3% higher in Thursday’s premarket.

A bullish Stocktwits believes the stock is undervalued.

Another user expressed skepticism about the company.

Alphabet’s Q2 revenue increased 14% year-on-year (YoY) to $96.43 billion, exceeding the analysts’ consensus estimate of $94.02 billion, as per Fiscal AI data. Google Search revenue climbed 12% to $54.19 billion.

The earnings per share (EPS) of $2.31 also exceeded the consensus estimate of $ 2.20.

Alphabet stock has gained only 0.4% year-to-date and more than 10% over the last 12 months.

2. Manhattan Associates Inc. (MANH): The software solutions provider saw retail message count explode by 500% in 24 hours on sustained momentum after better-than-expected Q2 earnings on Tuesday.

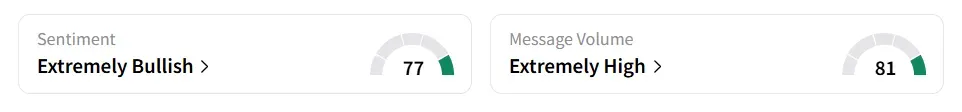

Retail sentiment around the stock remained in ‘extremely bullish’ (77/100) territory amid ‘extremely high’ (81/100) message volume levels. Both the retail sentiment and message volume hit a three-month high.

The company’s Q2 revenue increased 2.3% YoY to $272.4 million with an adjusted EPS of $1.31, both above the analysts’ consensus estimate of $263.74 million and $1.13, respectively, as per Fiscal AI data.

Manhattan Associates stock inched 0.5% lower in Thursday’s premarket. The stock has lost over 19% in 2025 and 12% in the past 12 months.

3. AT&T Inc. (T): The company experienced a 430% surge in retail message count in the last 24 hours after better-than-expected Q2 earnings.

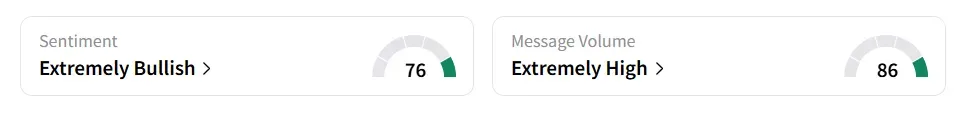

Retail sentiment around the stock remained in ‘extremely bullish’ territory with ‘extremely high’ message volume levels.

AT&T stock inched 0.3% lower in Thursday’s premarket. The stock has gained over 21% in 2025 and over 44% in the last 12 months.

The telecom giant’s Q2 revenue increased 3.5% year-on-year (YoY) to $30.8 billion, beating the analysts' consensus estimate of $30.4 billion as per Fiscal AI data.

Also See: Trump Schedules Rare Fed Visit As Tensions With Powell Simmer

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)