Advertisement|Remove ads.

Altimmune Stock Slides After New CFO Appointment, Retail Bulls Eye M&A Potential

Shares of Altimmune, Inc. ($ALT) fell nearly 8% on Monday afternoon after the biopharma company announced the appointment of Greg Weaver as its new Chief Financial Officer.

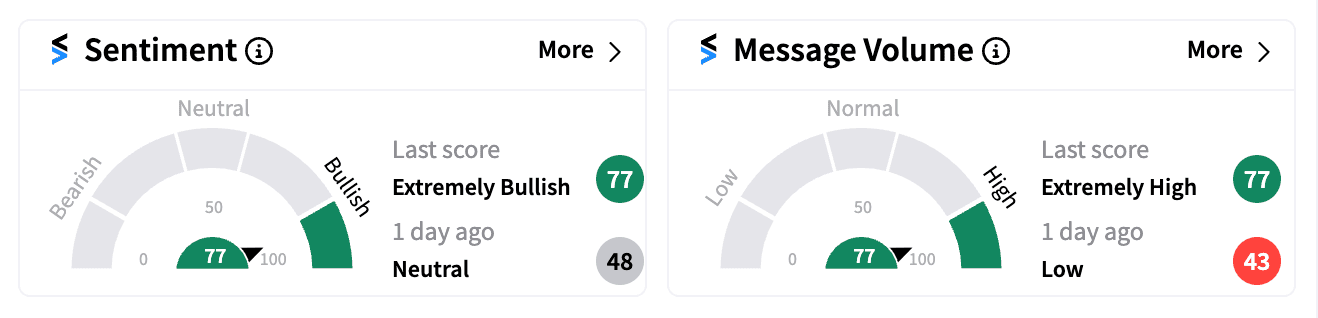

Despite the stock price drop, retail sentiment flipped to ‘extremely bullish’ on Stocktwits, with traders speculating on deeper implications of the hire.

Weaver, who previously served as CFO of Cognito Therapeutics, will oversee Altimmune’s finance, accounting, SEC reporting, and investor relations functions.

Altimmune’s CEO, Vipin K. Garg, praised Weaver’s extensive experience, particularly during a “pivotal time” for the company as it advances its lead obesity drug candidate, pemvidutide, into phase 3 trials.

Weaver’s background includes CFO roles at several biotech firms acquired in high-profile deals, such as Sirna Therapeutics (acquired by Merck) and ILEX Oncology (acquired by Genzyme), according to the press release.

Altimmune also disclosed that Weaver received significant equity awards as part of his compensation package, including options to purchase 225,000 shares of common stock and 75,000 restricted stock units.

Several retail investors on Stocktwits were quick to speculate on Weaver’s hiring, with many interpreting it as a strategic move towards a potential merger or acquisition.

One user noted that Altimmune “made sure to highlight his M&A experience,” suggesting that the company may be positioning itself as a takeover target.

Another post emphasized the importance of having an experienced CFO for major acquisition activities, fueling more speculation.

The CFO announcement comes on the heels of Altimmune’s recent agreement with the FDA on key efficacy and safety measures for its phase 3 trials of pemvidutide, a promising obesity treatment.

The company recently highlighted that pemvidutide has shown weight-loss efficacy comparable to Novo Nordisk’s Wegovy but with better lean mass preservation, which could be a differentiator in a highly competitive obesity market dominated by Eli Lilly and Novo Nordisk.

During a presentation at the Guggenheim Securities Healthcare Innovation Conference on Monday, Altimmune mentioned that the FDA is closely watching potential cardiotoxic effects of glucagon, a concern for obesity treatments. The company speculated that there might be something there that "raised the attention of the [FDA]. We don't know for certain."

On Stocktwits, ALT has garnered significant retail attention: it has added nearly 30% more new watchers over the past year, while message volume has nearly quadrupled in the same period.

However, Altimmune’s stock is still down over 30% year-to-date. With phase 3 trials on the horizon and a seasoned CFO now on board, Altimmune remains a stock to watch in the biopharma space.

For updates and corrections, email newsroom@stocktwits.com

Read next: GameStop Heats Up, Boosts Retail Sentiment As Meme Stock Eyes Longest Winning Streak Since July

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231498932_jpg_bdd44fc548.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_AEHR_chip_maker_3698bf2343.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2205870269_jpg_b38339787f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)