Advertisement|Remove ads.

Amazon Loses Dismissal Bid In COVID-Era Price Gouging Case: Report

- The original lawsuit claimed that consumers suffered losses due to Amazon’s failure to take steps to prevent sellers on its platform from charging excessive prices during the pandemic.

- As per the complaint, the price of Aleve pain relief tablets rose 233%, Quilted Northern toilet paper saw a 1,044% increase, while Arm & Hammer baking soda prices rose 1,523% in the period.

- Consumers also alleged that Amazon increased prices on its own products to profit from consumers in desperate need.

Amazon.com’s (AMZN) bid to dismiss a lawsuit in which the company was accused of price gouging during the COVID-19 pandemic has reportedly been rejected by a judge in the U.S.

According to a Reuters report, U.S. District Judge Robert Lasnik in Seattle, said that the claim from Amazon was "unpersuasive." Amazon had claimed that the Washington state consumer protection laws were vague as applied to pricing.

The original lawsuit claimed that consumers suffered losses due to Amazon’s failure to take steps to prevent sellers on its platform from charging excessive prices during the pandemic.

Shares of AMZN were down 0.15% in Monday’s after-market hours at the time of writing.

Lawsuit Details

U.S. consumers who filed the lawsuit sought damages for "unfair" prices for items like food and other consumer goods on the internet platform between January 31, 2020 and October 20, 2022, as per the report. This was at the height of COVID emergency in Washington and other states.

As per the complaint, the price of Aleve pain relief tablets rose 233%, Quilted Northern toilet paper saw a 1,044% increase while Arm & Hammer baking soda prices rose 1,523%.

American consumers said in the complaint that even as Amazon failed to prevent sellers from using its platform to charge "flagrantly unlawful" prices for food and other staples, the company also increased prices on its own products to profit from consumers in desperate need.

Lawyer for the consumers, Steve Berman, said that the decision was an important win for consumers. He also added that internal Amazon documents showed that the online retailer was aware of what price gouging was and had assured state attorneys general that it was trying to stop the same.

Street Action

In other news, Wolfe Research lowered Amazon’s price target to $275 from $305 and maintained an ‘Outperform’ rating on the company’s shares.

Analyst Shweta Khajuria said that while 2026 could be one more positive year for Internet stocks, the outperformance may not be similar to the previous three years on account of the current, elevated multiples for some of the firm's coverage, as per TheFly.

Wolfe Research added that it foresaw some opportunities for estimates upside, citing AI developments, product catalysts, a reasonably healthy macro backdrop, successful capital allocation, and pockets of re-rating potential.

How Did Stocktwits Users React?

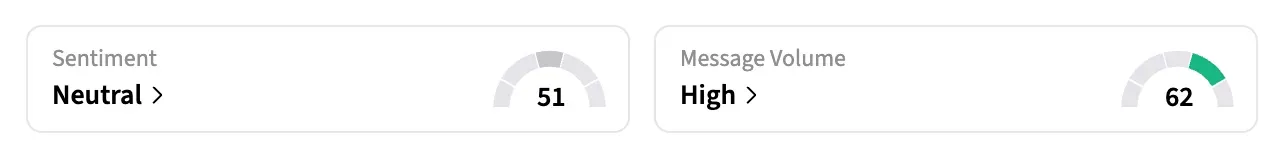

On Stocktwits, retail sentiment around AMZN shares jumped to ‘neutral’ from ‘bearish’ territory a day ago amid ‘high’ message volumes.

Shares of AMZN rose 2.4% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)