Advertisement|Remove ads.

Amazon Stock Hits All-Time Highs: Cramer Says ‘I Do Think That This Company Is Back’

- CNBC’s Jim Cramer said Amazon’s latest earnings were a “show of major force”.

- The third quarter was the first time since 2022 that AWS returned to growth above 20%.

- AWS has partnered with Artificial Intelligence Technology Solutions Inc. to advance the development of the latter’s AI platform, SARA.

Amazon.com Inc. (AMZN) stock hit an all-time high of $250.50 on Friday after delivering a blockbuster third-quarter (Q3) performance that reignited investor confidence.

The company’s results showcased renewed strength in its cloud division, Amazon Web Services (AWS), which reported $33 billion in revenue for Q3, marking 20% Y-o-Y growth.

Jim Cramer’s Comments On Amazon

CNBC’s Jim Cramer said Amazon’s latest earnings were a “show of major force” led by CEO Andy Jassy, whose confident tone during the post-earnings call impressed analysts.

According to a CNBC report, Q3 marked the first time since 2022 that AWS returned to growth above 20%, a milestone that helped alleviate concerns about slowing momentum compared to competitors Microsoft Corp. (MSFT) and Alphabet Inc. (GOOG, GOOGL).

Cramer noted that Jassy’s confident approach has put the bears to rest. “I do think that this company is back,” he said.

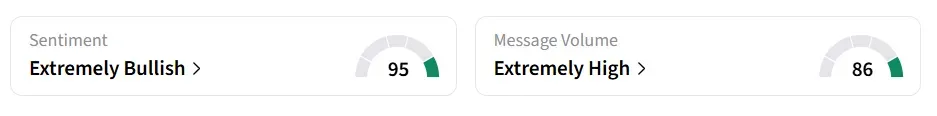

At the time of writing, Amazon’s stock pared some of the gains and traded over 10% higher. The stock was the top trending equity ticker on Stocktwits. Retail sentiment around the stock remained in ‘extremely bullish’ territory. Message volume improved to ‘extremely high’ from ‘high’ levels in 24 hours.

Heightened AI Demand

Amazon has raised its 2025 capital expenditure estimate to $125 billion, up from $118 billion previously, and stated that the figure is likely to increase next year.

In a move to ramp up its AI engagement, AWS is collaborating with Artificial Intelligence Technology Solutions Inc. to advance the development of the latter’s AI platform, SARA (Speaking Autonomous Responsive Agent).

Improvements achieved through AWS’s GenAI Innovation Center will make SARA a stronger competitor in the intelligent monitoring systems market, with enhanced data processing and real-time learning capabilities.

Amazon’s stock has gained over 12% in 2025 and over 32% in the last 12 months.

Also See: Why Did ROKU Stock Surge 9% Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)