Advertisement|Remove ads.

Amazon Stock Lands Bullish Calls From KeyBanc, Stifel Ahead Of Q3 Report: Retail Investors Await Promised Upswing

- KeyBanc initiated coverage on AMZN with an ‘Overweight’ rating and a $300 price target.

- Stifel increased its price target to $269 from $260.

- Amazon will report Q3 results on Oct. 30.

KeyBanc on Thursday placed an ‘Overweight’ rating on Amazon.com, Inc.’s shares, while Stifel increased its price target on the stock – just ahead of the e-commerce and cloud giant’s earnings report next week.

KeyBanc said investors drove the stock lower on pessimism over Amazon’s cloud business, creating an attractive entry point. The research firm initiated coverage with a $300 price target, adding that Amazon's current valuation multiple is "well below historical levels." That implies a 36% upside to the stock’s last close.

That’s the main debate among retail investors of late. Despite Amazon looking resilient on all fronts, the stock has failed to break out. It’s traded rangebound since the last earnings report and is up a mere 0.8% year-to-date, the worst run among the “Magnificent Seven” stocks.

Earlier this week, Amazon made headlines after an outage in its cloud unit, Amazon Web Services, took down dozens of services like Gmail and Snapchat, and disrupted hundreds of businesses. Amazon will likely have to compensate affected customers, and more details of the incident might be revealed during the earnings.

Stifel raised its target to $269 from $260, implying a 22% upside from the last close, and kept a ‘Buy’ rating. The firm noted stable trends in consumer prices and sales in the third quarter, while the expansion of same-day grocery delivery for Prime members may leave some upside for 2026.

Currently, 67 of 69 analysts have a ‘Buy’ or higher rating, with the remaining advising ‘Hold,’ according to Koyfin data.

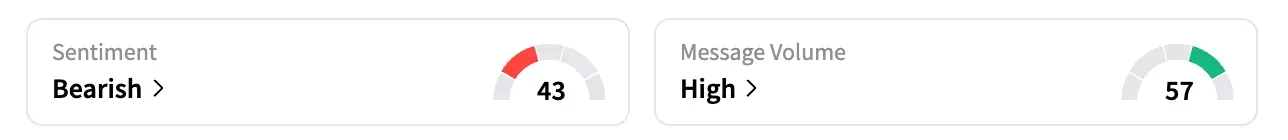

On Stocktwits, the retail sentiment for AMZN has been ‘bearish,’ unchanged over the week. “$AMZN waiting and watching for the big run up,” a user said with the picture of a raccoon standing upright, summarizing the mood.

For the third quarter, analysts expect Amazon's sales to rise 12% to $177.7 billion, while its EPS is expected to rise to $1.56 from $1.43 a year ago.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_snap_resized_jpg_9672f61595.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kalshi_logo_jpg_d4ea268948.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1249125319_jpg_31d1207b8e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)