Advertisement|Remove ads.

AMC Is Stuck In A 10-Day Losing Streak — And Now The CEO Says A Side Bet On Hycroft Mining Stock Is Finally Paying Off

- AMC shares have fallen sharply in 2025 amid debt, refinancing and dilution concerns.

- Hycroft stock surged on record metals prices and positive drilling updates.

- AMC retains limited exposure to Hycroft after monetizing most of its stake.

Shares of AMC Entertainment Holdings were on track for a tenth straight session of losses on Monday, extending a prolonged downturn that has dogged the company amid ongoing financial pressures.

Amid the decline, Chairman and CEO Adam Aron highlighted gains tied to AMC’s remaining exposure to Hycroft Mining Holding Corp. In a post on X, Aron said Hycroft’s share price was “exploding upwards,” adding that AMC’s initial $28 million investment, including proceeds from a recent partial stock sale and retained warrants and shares, was now worth about $41 million on a mark-to-market basis. He concluded the post by saying, “He who laughs last, laughs best.”

AMC’s Debt Problems Keep Pressure On Stock

AMC’s stock has fallen more than 60% in 2025, pressured by high debt levels, refinancing challenges and the dilutive impact of repeated equity raises.

The company has spent much of the past year working through a heavily leveraged balance sheet following years of pandemic-era disruption, including a July agreement with bondholders that ended litigation tied to its 2024 debt restructuring but introduced further dilution and complex capital changes.

AMC has also reported large quarterly net losses driven by refinancing-related non-cash charges, even as operating trends have shown improvement.

Separately, the company reported its biggest pre-Christmas holiday weekend since 2021, with more than 4 million moviegoers visiting AMC and ODEON cinemas, highlighting resilient demand for theatrical releases led by Avatar: Fire & Ash.

Hycroft Shares Jump As Metals Rally

Hycroft shares surged over 55% on Monday as gold and silver prices reached record highs earlier in the day. Gold climbed to an all-time peak of $4,420.01, while spot silver touched $69.44.

The rally also followed Hycroft’s December update reporting its highest silver grades and longest continuous intercept to date from its 2025–2026 exploration drilling program in Nevada.

AMC Previously Monetized Majority Of Stake

In early December, AMC transferred the majority of its equity investment in Hycroft to Sprott Mining for net consideration of about $24.1 million, roughly matching the capital originally invested. AMC retained over one million warrants and a small direct equity stake to participate in future upside.

The transaction was expected to generate an accounting profit of about $7.9 million in the fourth quarter of 2025, while freeing up capital for the core theatrical business.

How Did Stocktwits Users React?

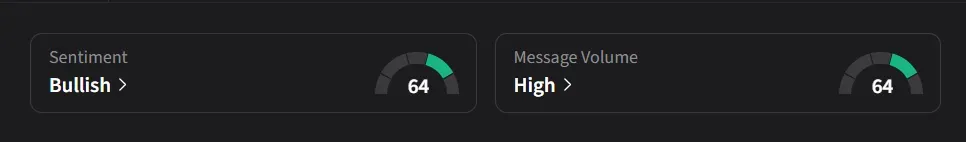

On Stocktwits, retail sentiment for AMC was ‘bullish’ amid ‘high’ message volume.

One user said that after nearly five years of following the stock closely, they believe it has been heavily manipulated and expect an extreme upside move.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)