Advertisement|Remove ads.

AMC vs. Cinemark: Retail Picks Clear Theatrical Winner After Upbeat Q2 Reports

Recently, theater chains AMC Entertainment Holdings (AMC) and Cinemark Holdings Inc. (CNK) managed to surpass earnings expectations, but retail investor sentiment has tilted decisively in favor of only one, based on a stronger performance and a healthier balance sheet.

AMC’s Debt Load Lingers: Despite reporting a lesser-than-feared Q2 loss, according to Stocktwits data, AMC's stock price has declined since the results. The world's largest theater chain continues to grapple with a substantial debt load of over $4 billion, which has constrained its financial flexibility.

The company’s overall performance was hindered by the lingering impact of the 2023 Hollywood strikes and a challenging operating environment. The success of Disney and Marvel’s "Deadpool & Wolverine" is expected to turn fortunes around a bit.

AMC’s “meme stock” status has contributed to its volatility, but it has also made the company susceptible to rapid shifts in investor sentiment.

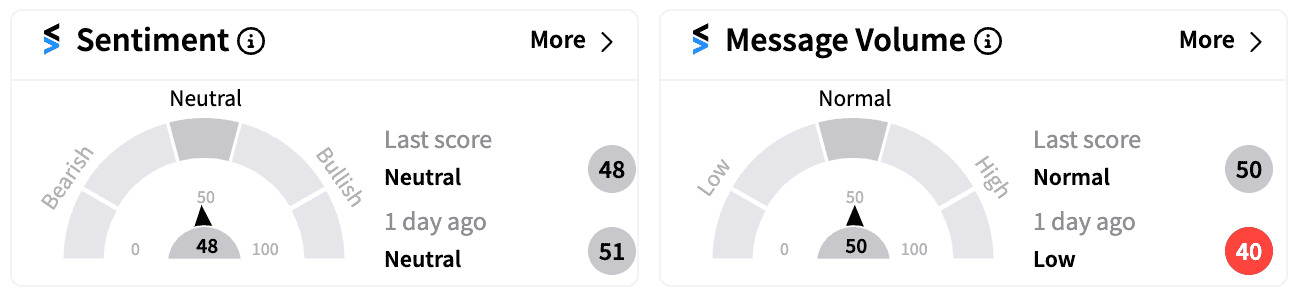

Stocktwits data currently indicates a ‘neutral’ retail sentiment for AMC (48/100), reflecting lingering investor concerns about the company's financial health, even as CEO Adam Aron called recent debt-extension transactions "a literal game changer".

The company's cash and cash equivalents at June 30, 2024, stood at $770.3 million, which while substantial, is still required to manage its debt obligations.

Cinemark Cheer Grows: In contrast, Cinemark has delivered a stronger performance. The company reported a profit of $0.32 per share, exceeding analyst expectations by a significant margin. While revenue declined year-over-year, it surpassed estimates.

Cinemark's lower debt burden of $2.25 billion provides it with greater financial flexibility, enabling it to invest in theater upgrades and expansions.

The company's recent success with "Deadpool & Wolverine," which achieved its highest-ever domestic opening weekend, further bolstered its position in the market.

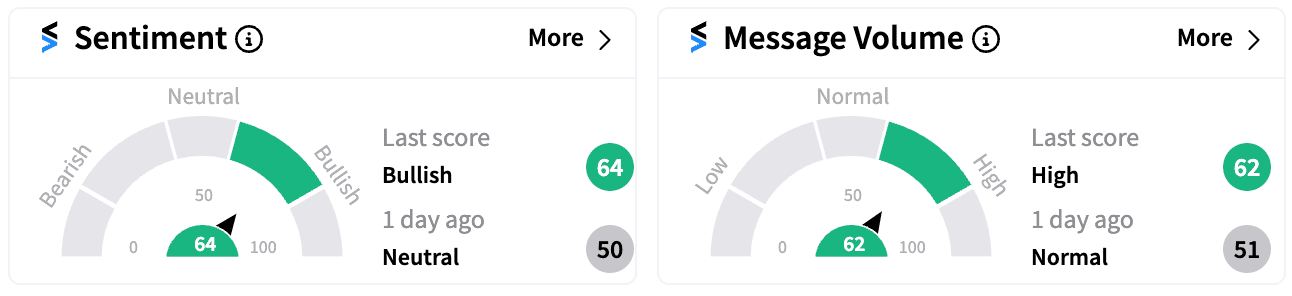

Stocktwits data shows a ‘bullish’ sentiment (64/100) for CNK, reflecting investor confidence in the company’s financial performance and growth prospects.

Cinemark’s cash and cash equivalents at June 30, 2024, stood at $788.8 million, slightly higher than AMC’s, providing additional financial cushion.

“$CNK is well-managed and profitable. Mystery solved,” Stocktwits user Oliver202115 wrote.

Analyst ratings on Monday have also been more favorable for Cinemark, with JP Morgan maintaining a ‘neutral’ rating but raising the price target to $25, while Wedbush reiterated a ‘neutral’ rating on AMC with a $4 price target, saying, “We expect AMC's shares to remain volatile as its shareholders dislike its frequent share issuances.”

Photo courtesy: Cinemark

/filters:format(webp)https://news.stocktwits-cdn.com/large_oil_neww_a4e4f5f75e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Sourasis_Bose_Author_Image_939f0c5061.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_psychedelics_brain_resized_b52324b5d5.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1496337898_jpg_8e75bdf43f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243968069_jpg_3ccb34d8bd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_elon_musk_jpg_bfd8288cf2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_unh_stock_resized_jpg_e69fd915e3.webp)